What is DeFi? Guide to Decentralized Finance 2025-2026

What is DeFi in Crypto? A Complete Guide to Decentralized Finance (2025)

Imagine a world where you can lend, borrow, save, and earn interest on your money without ever setting foot in a bank. That world already exists — and it’s called DeFi, short for Decentralized Finance. In simple terms, DeFi is a movement that uses blockchain technology to rebuild traditional financial systems in a transparent, open, and permissionless way.

Instead of banks and institutions controlling your funds, DeFi allows you to control your assets directly through smart contracts — automated digital agreements running on blockchains like Ethereum. In 2025, DeFi has evolved into one of the most powerful forces in crypto, attracting millions of users and billions in total value locked (TVL). It’s not just for tech experts or investors anymore — it’s for anyone who wants more freedom and control over their money.

But why is DeFi such a big deal? Because it changes the rules of finance. It removes middlemen, reduces fees, and opens the doors of global financial services to anyone with an internet connection. In this guide, we’ll break down what DeFi is, how it works, its main components, advantages, risks, and what the future holds. By the end, you’ll see how decentralized finance is quietly transforming the way the world manages money.

Key Components of DeFi

DeFi is not one single platform or app. It’s an entire ecosystem made up of many different parts that work together — like the organs in a living body. To understand how DeFi works, let’s explore its key components: smart contracts, liquidity pools, decentralized exchanges (DEXs), staking, and lending protocols.

1. Smart Contracts — The Brains of DeFi

At the heart of every DeFi application are smart contracts. These are self-executing computer programs that automatically carry out transactions when certain conditions are met. Think of them as digital vending machines: you put in your tokens, and if the requirements are correct, you instantly get what you paid for — no humans involved.

For example, if Alice wants to lend her crypto to Bob, she doesn’t need a bank to manage it. Instead, a smart contract ensures that Bob receives the loan and that Alice automatically gets her money back with interest. This automation is what makes DeFi efficient and transparent — everything happens on the blockchain, visible to everyone.

2. Liquidity Pools — The Fuel of DeFi

Liquidity pools are like communal vaults where users deposit their crypto assets to enable trading and lending on DeFi platforms. Imagine a big pot of digital coins that anyone can contribute to and draw from. In return for providing this liquidity, users earn a share of transaction fees or interest — similar to how a bank rewards you for keeping money in a savings account, but with higher flexibility and transparency.

Platforms like Uniswap and Balancer rely on liquidity pools to allow instant crypto swaps without relying on traditional buyers and sellers. Instead of waiting for a matching order, trades happen directly against these pools — ensuring constant liquidity and fair pricing based on supply and demand.

3. Decentralized Exchanges (DEXs) — Trading Without Middlemen

Decentralized exchanges, or DEXs, are marketplaces where users can trade cryptocurrencies directly from their wallets. No registration, no KYC, no centralized control. It’s peer-to-peer trading powered entirely by smart contracts.

Think of DEXs as farmers’ markets for digital assets — everyone brings their goods (tokens) and trades freely without needing a corporate intermediary. Platforms like Uniswap, SushiSwap, and PancakeSwap have become the go-to places for swapping tokens quickly, privately, and securely.

These exchanges represent one of the most successful parts of decentralized finance because they allow anyone, anywhere, to trade without censorship or restrictions — truly embodying the “decentralized” spirit of crypto.

4. Staking — Earning Rewards by Locking Your Crypto

Staking is one of the most popular ways to earn passive income in the DeFi world. When you stake your crypto, you’re locking it into a blockchain network to help secure it and validate transactions. In return, you receive rewards — often in the form of new tokens. It’s like depositing your money into a high-yield savings account, but instead of a bank, you’re supporting a decentralized network.

For example, when users stake their Ethereum on platforms like Lido or Rocket Pool, they contribute to the network’s security and receive staking rewards. This process not only encourages long-term commitment to the blockchain but also gives everyday users the chance to participate in the financial infrastructure of the future.

Staking in DeFi is accessible and flexible — you can choose how much to stake, for how long, and often unstake your assets whenever you want. It’s a key feature that shows how decentralized finance empowers users to make money work for them, rather than relying on institutions to do it.

5. Lending and Borrowing Protocols — The DeFi Banks

Traditional banks lend out your deposits to make profits — but they rarely share those profits with you. DeFi changes that dynamic entirely. With decentralized lending and borrowing protocols like Aave, Compound, and MakerDAO, you can lend your crypto directly to others and earn interest, or borrow against your own holdings without ever meeting a banker.

These platforms operate using smart contracts that automatically handle the entire process: from loan creation to repayment. For example, if you lend $1,000 worth of stablecoins on Aave, you immediately start earning interest. If you borrow, the collateral you provide is securely held in a smart contract until the loan is repaid. Everything is transparent, predictable, and governed by code — not people.

This peer-to-peer model not only reduces costs but also opens financial opportunities to people worldwide who don’t have access to traditional banking services. It’s a simple yet powerful way to understand why decentralized finance is often called “banking without banks.”

How DeFi Works

Now that you know the core components of decentralized finance, let’s look at how DeFi actually works behind the scenes. Don’t worry — we’ll keep it simple and visual. You don’t need to be a programmer to grasp the basics of how DeFi transactions happen on the blockchain.

In traditional finance, every transaction involves middlemen: banks, payment processors, and regulators. DeFi removes all of them by replacing human intermediaries with smart contracts — automated pieces of code that execute actions once conditions are met. Everything happens on the blockchain, which acts like a public digital ledger accessible to anyone, anytime.

Step 1: Setting Up a Crypto Wallet

To interact with DeFi platforms, you first need a crypto wallet — your digital gateway to the decentralized world. Think of it as your online bank account, but one that you fully control. Popular wallets like MetaMask or Trust Wallet let you store, send, and receive crypto while connecting to DeFi applications directly through your browser.

Unlike bank accounts, wallets don’t require ID verification, paperwork, or approval. You just create one, back up your recovery phrase, and you’re ready to start exploring the DeFi universe. This accessibility is one of the key reasons DeFi has exploded in popularity.

Step 2: Connecting to a DeFi Platform

Once your wallet is ready, you can visit a DeFi platform — for example, Uniswap for trading, Aave for lending, or Yearn Finance for yield farming. With one click, your wallet connects directly to the platform’s smart contracts. There’s no registration form, password, or approval process. You’re instantly in control.

From here, you can choose what to do: swap tokens, provide liquidity, lend assets, or stake tokens for rewards. Every action you take is processed through a smart contract, which ensures the transaction is secure and transparent.

Step 3: Executing a DeFi Transaction

When you confirm a transaction — say, swapping ETH for USDC — your wallet sends the request to the blockchain. The network validates the transaction, the smart contract executes it, and within seconds, you see the result in your wallet. Everything is recorded publicly on the blockchain, ensuring full transparency.

This process might sound complex, but in reality, it’s incredibly smooth. Most DeFi interfaces are designed to be intuitive, with clear buttons, real-time data, and estimated fees displayed upfront. Once you get used to it, performing a DeFi transaction feels as easy as sending an email.

Step 4: Earning Through DeFi

DeFi isn’t just about trading — it’s about making your assets work for you. You can earn through staking, yield farming, liquidity provision, or lending. Each method offers a different level of risk and reward, but the principle is the same: instead of your money sitting idle, it’s actively participating in the decentralized economy and generating income.

For instance, if you add tokens to a liquidity pool on Uniswap, you earn a portion of every trade fee that passes through that pool. Or if you lend on Aave, you earn interest paid by borrowers. DeFi turns everyone into a participant — not just a user — of the financial system.

Step 5: Transparency and Security

One of the greatest strengths of DeFi is transparency. Every transaction that takes place on the blockchain can be verified by anyone, anytime. There are no hidden fees, no secret manipulations, and no fine print buried in contracts. Everything is open and visible on the public ledger — a level of honesty traditional banks could never offer.

Security in DeFi comes from decentralization itself. There’s no single company or server to hack; the system runs across thousands of computers worldwide. However, while this makes DeFi more resilient, it doesn’t make it risk-free. Smart contracts can have bugs, and users still need to act responsibly — something we’ll cover later in the risks section.

Step 6: Freedom and Control

Perhaps the most powerful idea behind decentralized finance is freedom. You don’t need permission to use DeFi. There’s no banker to reject your loan, no institution to freeze your account, no government to devalue your savings overnight. If you have a smartphone and internet access, you can join the global financial system instantly.

It’s this sense of empowerment that attracts millions of people to DeFi every year. It’s finance built by people, for people — not by corporations or bureaucracies. You’re in control of your money, your choices, and your financial future.

Advantages & Risks of DeFi

Every revolution has two sides — opportunities and challenges. DeFi is no different. Let’s look at what makes decentralized finance so appealing, and what risks every beginner should understand before diving in.

Advantages of DeFi

1. Accessibility for Everyone

In traditional finance, millions of people are “unbanked” — they can’t open accounts, apply for loans, or invest. DeFi eliminates those barriers completely. All you need is an internet connection and a crypto wallet. There are no branches, no managers, and no credit checks. Whether you’re in New York, Nairobi, or New Delhi, you can access the same global financial tools 24/7.

It’s finance without borders, finally available to everyone equally. This inclusiveness is one of the biggest reasons DeFi is transforming the way the world thinks about money.

2. Lower Fees and Better Returns

Banks and payment companies make money by charging fees — transfer fees, withdrawal fees, maintenance fees, and more. DeFi cuts out these middlemen. By replacing human intermediaries with smart contracts, DeFi platforms can operate at a fraction of the cost.

That means users keep more of what they earn. For instance, lending on Aave or providing liquidity on Uniswap allows you to earn directly from other users, not from a corporation taking a cut. The result is a system that’s leaner, faster, and fairer for everyone.

3. Transparency and Trust

DeFi is built on transparency. Every transaction, rule, and interest rate is recorded publicly on the blockchain. You don’t need to trust a company’s word — you can verify everything yourself. This open design builds trust through technology rather than reputation, creating a financial system that is truly accountable.

4. Control and Ownership

When you use DeFi, your assets remain in your control. You don’t “deposit” funds into a company’s account; you interact with smart contracts directly from your wallet. That means you can withdraw or move your funds anytime you wish, without asking anyone’s permission.

It’s like keeping your money in a digital vault where only you hold the key. In a world where traditional banks can freeze or limit access to your funds, that kind of independence is priceless.

5. Innovation and Open Opportunities

Because DeFi is open-source, anyone can build on top of it. Developers from all over the world continuously create new tools, platforms, and opportunities — from yield farming to decentralized insurance and algorithmic stablecoins. This constant innovation keeps DeFi fresh, dynamic, and full of potential for early adopters.

Risks of DeFi

1. Smart Contract Vulnerabilities

Smart contracts are powerful, but they’re still written by humans — and humans make mistakes. If there’s a bug in the code, hackers can exploit it and drain funds. While major platforms like Aave and Uniswap undergo security audits, no system is 100% safe.

The good news is that the DeFi community constantly improves its standards, introducing insurance protocols and multi-layer protection to reduce these risks. Still, users should always research a platform’s reputation before investing.

2. Impermanent Loss

If you provide liquidity to a pool (like ETH/USDC on Uniswap), you might experience something called impermanent loss. In simple terms, it means that when token prices change significantly, the value of your deposited assets may temporarily decrease compared to just holding them. It’s not a total loss, but it’s something to understand before joining a liquidity pool.

3. Market Volatility

Crypto markets move fast — sometimes too fast. Prices can swing dramatically within hours, which affects yields, collateral ratios, and the value of your holdings. Beginners should start small and never risk more than they can afford to lose.

4. Scams and Fake Projects

Because DeFi is open to everyone, not all projects are honest. Some copy legitimate platforms and disappear with users’ funds — so-called “rug pulls.” Always double-check URLs, verify contracts, and stick to trusted platforms listed on reputable aggregators like DeFiLlama or CoinGecko.

5. Lack of Regulation

Traditional finance operates under strict rules and legal frameworks. DeFi, being decentralized, doesn’t. While this allows innovation, it also means there’s no customer support or refund if something goes wrong. The responsibility lies with the user — and that’s why education and awareness are essential before diving into decentralized finance.

DeFi in 2025: The Future

The world of decentralized finance is evolving fast. By 2025, DeFi is no longer just a niche for crypto enthusiasts — it’s a thriving, innovative ecosystem shaping the way people manage money globally. Let’s explore the key trends and innovations that make the future of DeFi exciting for beginners and experienced users alike.

1. Layer 2 Solutions — Faster and Cheaper Transactions

One of the biggest challenges in early DeFi was slow transaction speeds and high fees on networks like Ethereum. Layer 2 solutions solve this by processing transactions off the main blockchain while still maintaining security. Think of it like building express lanes on a crowded highway — transactions move faster, cheaper, and more efficiently.

This innovation means users can trade, stake, and lend without worrying about exorbitant fees, making DeFi even more accessible for everyday participants.

2. NFTs in DeFi — Beyond Art

Non-fungible tokens (NFTs) are no longer just digital art or collectibles. In DeFi, NFTs are being used as collateral, proof of ownership, or even for unique investment opportunities. Imagine using a rare digital asset as a key to unlock loans or special yields — this is a completely new way to think about ownership and value.

3. Stablecoins — Bridging Crypto and Real-World Value

Stablecoins, cryptocurrencies pegged to real-world assets like the US dollar, are becoming increasingly important in DeFi. They reduce volatility while allowing users to enjoy the benefits of blockchain — instant transfers, transparency, and global access. By 2025, stablecoins will be a core building block of most DeFi platforms, providing a safer entry point for beginners.

4. Cross-Chain Liquidity — A Connected DeFi Universe

Future DeFi platforms will connect multiple blockchains, allowing assets to move freely between ecosystems. It’s like creating bridges between islands — suddenly, liquidity and opportunities are no longer confined to a single network. This will enable more diverse investments, better yields, and smoother trading experiences.

5. DeFi Governance Tokens — Everyone Has a Voice

Many platforms now issue governance tokens, allowing users to vote on decisions like fee structures, new features, or security upgrades. In essence, users become co-owners of the platform, shaping its future collectively. It’s like joining a financial cooperative, but digital and global — your participation directly impacts how the platform evolves.

6. Simplified User Experience

By 2025, DeFi platforms are becoming much more user-friendly. Interfaces are cleaner, wallets are easier to use, and educational resources are integrated directly into the apps. Beginners can start staking, lending, or trading without feeling lost. The barrier to entry is falling, making it easier than ever to explore decentralized finance safely and confidently.

Conclusion and Recommendations

Decentralized finance is more than a trend — it’s a new way of thinking about money, control, and opportunity. By removing intermediaries, lowering fees, and opening global access, DeFi empowers individuals to take control of their financial lives in ways that were impossible with traditional banks.

For beginners, the key to success in DeFi is to start small, stay informed, and use trusted platforms. Begin by setting up a secure crypto wallet, experiment with staking or lending minimal amounts, and gradually expand as you gain confidence. Remember, education is your best protection against risks like impermanent loss, smart contract vulnerabilities, or market volatility.

Practical steps to get started:

- Set up a secure wallet like MetaMask or Trust Wallet.

- Connect to a well-known DeFi platform such as Uniswap or Aave.

- Start with small transactions — provide liquidity, stake tokens, or lend crypto.

- Track your earnings and learn from each experience before scaling up.

- Keep learning: follow DeFi news, check security updates, and explore new innovations.

By approaching DeFi cautiously yet confidently, anyone can participate in the financial revolution and benefit from the opportunities it offers. The future is decentralized, and it’s open to everyone willing to take the first step.

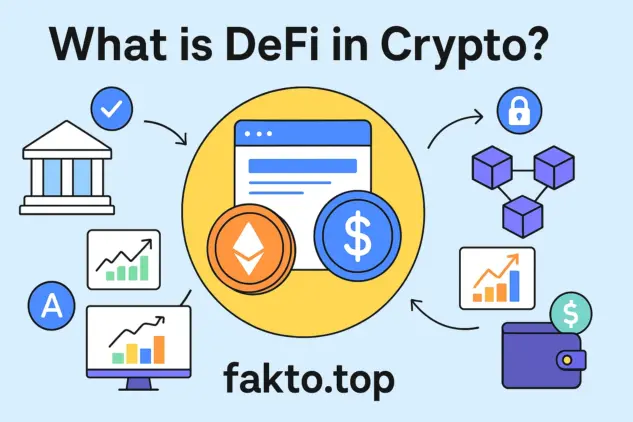

Visualizing DeFi: Easy-to-Understand Graphics

1. DeFi Ecosystem Diagram

To see how DeFi works as a whole, imagine a city where each building represents a financial service:

- Smart contracts: the city’s traffic lights, ensuring everything moves correctly.

- Liquidity pools: the reservoirs that supply energy to all buildings.

- Decentralized exchanges: the marketplaces where people trade goods (tokens) directly.

- Staking platforms: the city’s banks where citizens deposit resources to earn rewards.

- Lending protocols: peer-to-peer loan offices with no managers, just rules enforced by code.

Alt text: “DeFi ecosystem diagram explaining smart contracts, liquidity pools, DEXs, staking, and lending.”

2. Comparison Table: DeFi vs Traditional Finance

| Feature | Traditional Finance | DeFi (2025) |

|---|---|---|

| Control | Bank manages your funds | You control your wallet |

| Fees | High, multiple fees | Low, mostly network fees |

| Accessibility | Limited by country, documents | Global, open to anyone with internet |

| Speed | Days for transfers or loans | Seconds to minutes via smart contracts |

| Transparency | Opaque processes | Fully public on blockchain |

Alt text: “DeFi vs traditional finance table showing differences in control, fees, accessibility, speed, and transparency.”

3. Flowchart: How a DeFi Transaction Works

Example: Lending crypto on Aave

- User deposits crypto into Aave smart contract

- Smart contract verifies deposit and stores funds

- Borrowers access funds using collateral

- Interest accrues and is automatically distributed to lenders

- User withdraws original deposit plus earned interest

Alt text: “Flowchart showing step-by-step how a DeFi lending transaction works on Aave.”

4. Bar Chart: DeFi Market Growth

DeFi’s growth has been exponential. The market cap has skyrocketed over the past few years, and projections for 2025 show continued expansion. Imagine the DeFi ecosystem as a rapidly growing tree, with each branch representing a new platform, token, or financial innovation.

Alt text: “Bar graph showing the growth of DeFi market cap over the past years and projections for 2025.”

5. Security Risk Infographic

DeFi offers freedom and rewards, but every opportunity comes with risks. Here’s a simplified infographic concept:

- Smart Contract Bugs: code mistakes can be exploited

- Impermanent Loss: temporary losses in liquidity pools

- Market Volatility: sudden price swings

- Scams: fraudulent projects or rug pulls

- Regulatory Gaps: lack of legal protections

Alt text: “DeFi security risk infographic showing smart contract bugs, impermanent loss, market volatility, scams, and regulatory gaps.”

Internal and External Linking

To deepen your understanding, explore other guides and tutorials:

For authoritative external sources:

DeFi Data in 2025: Trends That Will Carry Into 2026

As of 2025, DeFi continues to grow steadily and predictably. The total value locked (TVL) across major DeFi platforms has reached over $150 billion, showing consistent year-on-year growth. While the market fluctuates slightly day-to-day, the underlying structure of decentralized finance is mature enough that we don’t expect any drastic changes in 2026. This stability makes it an excellent time for beginners to explore DeFi confidently.

Key statistics from 2025:

- Major Platforms: Uniswap, Aave, Compound, MakerDAO, and Lido dominate usage.

- Liquidity Pools: Average annual yield for top pools ranges from 5% to 15%.

- Staking: Ethereum and other major PoS chains offer staking rewards of 4–8% annually.

- DeFi Users: Over 10 million unique wallets actively participating.

- Security: 90% of funds are secured by audited smart contracts; risks remain manageable with proper precautions.

These figures are expected to remain relevant in 2026, as the core DeFi infrastructure has reached a point of maturity. While new projects and minor innovations will continue, the essential ways to trade, stake, lend, and provide liquidity will remain the same.

Conclusion and Final Recommendations

Decentralized finance is not a passing trend — it’s a fundamental shift in how money works. By giving individuals direct control, transparency, and the ability to earn without middlemen, DeFi empowers people worldwide. In 2025, these opportunities are clear and stable, with little expectation for radical changes in 2026. Beginners can approach DeFi with confidence, knowing the principles and tools are here to stay.

For anyone starting out, here’s a practical roadmap:

- Create a secure wallet: MetaMask or Trust Wallet are reliable choices.

- Start small: Try lending, staking, or providing liquidity with modest amounts.

- Choose trusted platforms: Stick to established names like Uniswap, Aave, or Compound.

- Track results: Monitor earnings, fees, and risks regularly.

- Learn continuously: Stay updated on trends, tutorials, and security tips.

DeFi is a space where learning and participation go hand in hand. By starting carefully and gradually exploring more opportunities, you can enjoy the benefits of decentralized finance while minimizing risks. Remember, in 2025 and beyond, DeFi is stable, mature, and ready for anyone willing to take the first step.

Call to Action

If you’re ready to explore DeFi, start by setting up a wallet, connecting to a platform like Uniswap or Aave, and experimenting with small transactions. The decentralized financial world is open, global, and accessible — your journey can begin today. Don’t wait for perfect conditions; the best time to participate in DeFi is now, using the 2025-tested platforms and approaches that will remain relevant in 2026.

Remember: DeFi is about empowerment, transparency, and opportunity. Take control of your financial future, start learning, and join millions of users already participating in this global financial revolution.

Disclaimer

The information provided in this article is for educational purposes only and does not constitute financial advice. DeFi and cryptocurrency investments carry risks, including the potential loss of your funds. Always conduct your own research, use trusted platforms, and consider consulting a financial advisor before participating in any decentralized finance activities.