Bitcoin Halving 2025: What to Expect

Bitcoin halving is one of the most anticipated events in the crypto world. It affects not just Bitcoin’s supply but often impacts its price and adoption. If you’re new to Bitcoin or crypto in general, this guide will help you understand what halving is, why it matters, and what to expect in 2025.

What Is Bitcoin Halving?

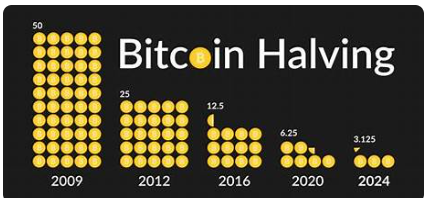

Bitcoin halving happens roughly every four years and cuts the reward miners get for adding new blocks to the blockchain in half. This is built into Bitcoin’s code to limit the total supply to 21 million coins, creating scarcity over time.

For context, when Bitcoin launched in 2009, miners earned 50 BTC per block. After three halvings, the reward is now 6.25 BTC. In 2025, it will drop to 3.125 BTC per block. Historically, this reduction in supply has played a big role in Bitcoin’s market cycles.

When Will the 2025 Halving Happen?

The next Bitcoin halving is expected around April 2025, but the exact date depends on network activity. Blocks are mined roughly every 10 minutes, so small variations can shift the timing by a few days or weeks.

What to Expect After Halving

1. Increased Scarcity

With block rewards cut in half, fewer new Bitcoins enter circulation each day. This growing scarcity could boost demand, especially if adoption continues to rise.

2. Price Volatility

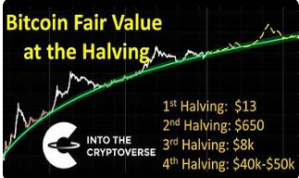

Historically, Bitcoin has seen major price increases after halvings. For example, the 2016 halving led into the 2017 bull run, and the 2020 halving preceded record highs in 2021. While past performance doesn’t guarantee the future, many analysts are optimistic about 2025.

3. Media Spotlight

Halvings attract media attention, putting Bitcoin in the headlines. This visibility can draw new investors and spark interest from those previously unsure about crypto.

Tips for Beginners

If you’re new to Bitcoin, the 2025 halving is a great opportunity to learn more about the crypto market. Here are a few steps to get started:

1. Learn

Take time to understand how Bitcoin works, what drives its value, and the risks involved. Knowledge is your best investment.

2. Start Small

You don’t need to invest huge amounts right away. Many platforms allow you to buy fractions of Bitcoin, so start with what you’re comfortable with.

3. Use a Secure Wallet

Make sure your Bitcoin is stored in a reliable wallet. Hardware wallets are often recommended for long-term storage.

The Future of Bitcoin

As the 2025 halving approaches, Bitcoin continues to evolve as a global asset. Its limited supply, growing adoption, and institutional interest make it appealing for both experienced investors and newcomers. While there will be ups and downs, many believe Bitcoin’s best days are ahead.

Now is a perfect time to explore Bitcoin’s potential and consider how it might fit into your financial plans. The key is to stay informed and make decisions aligned with your goals and risk tolerance.

After the April 2024 halving, many investors and analysts expect Bitcoin’s price to rise. However, crypto markets are highly volatile, and past results don’t guarantee future gains.

- Some experts predict Bitcoin could reach $150,000 by the end of 2025, with optimistic scenarios pushing it to $200,000.

Keep in mind, these predictions come with uncertainty. Factors affecting Bitcoin’s price include institutional investment, regulatory changes, and overall economic conditions.

In the future, Bitcoin may continue to strengthen its position as digital gold and a store of value. However, achieving this will require addressing challenges like network scalability, user experience improvements, and regulatory compliance.

In short, Bitcoin halving is a key event that affects the cryptocurrency’s supply and can influence its price. But predicting Bitcoin’s future requires considering many factors and keeping a close eye on market developments.