APR: What’s the Deal?

APR, or Annual Percentage Rate, is the yearly interest rate used to figure out how much a loan costs or how much you could earn from an investment. Basically, it tells you what you might pay or make over a year.

In traditional finance, APR usually pops up when we talk about loans. But in crypto, it’s everywhere—staking, liquidity farming, and other ways to earn passive income. Knowing how APR works helps beginners make smarter choices and avoid surprises. Lots of newcomers ask, “What’s APR in crypto?” — this page breaks it down for you.

APR is a key number for investors. In crypto, it shows the percentage you could earn if you lock up your assets on a platform, like for staking or providing liquidity.

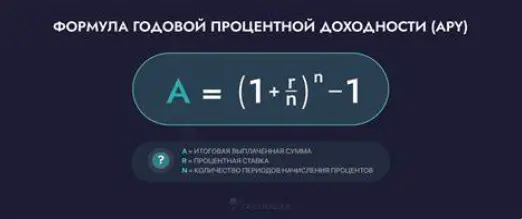

Remember: APR doesn’t account for compound interest. That means your earnings won’t magically grow just because your money sits there.

3 Quick Facts About APR:

- What it is: APR is the annual interest rate, showing either investment returns or the cost of a loan.

- How it works: In crypto, it’s the percent of your capital you could make in a year.

- APR vs. APY: Unlike APY, APR doesn’t factor in compounding, so reinvested earnings aren’t counted.

APR in Crypto: The Basics

In crypto, APR usually refers to returns from staking, liquidity farming, and similar earning methods. When you put your crypto into a platform for these activities, you get an APR — the percentage you could earn over a year. Keep in mind, APR can swing quite a bit because many projects have variable returns depending on market conditions.

For newbies, it can feel a bit confusing, but here’s the gist: APR helps you estimate how profitable your investment could be if you leave your funds in. That said, there’s always risk — crypto projects can change APRs or even shut down.

3 Key Points About APR in Crypto:

- The Concept: APR shows potential earnings from crypto investments.

- Variable Rates: Crypto APR can change, so keep an eye on it.

- Risk Factor: Returns aren’t guaranteed, so always consider the risk.

APR on Bybit: What It Means

Bybit is a major crypto exchange that lets users earn through staking and farming. When Bybit talks about APR, they mean the annual percentage you could earn by investing in certain crypto assets. Bybit has different ways to earn, and APR shows what’s possible. And don’t forget about fiat money if you’re dealing with exchanges.

On Bybit, you can pick products with different APR levels. For example, staking or liquidity farming might give you anywhere from 5% to 50% per year, depending on the asset and conditions. Just remember — APR isn’t guaranteed, and results depend on the market.

3 Things to Know About APR on Bybit:

- Options Galore: Bybit offers different ways to earn with staking and farming, each with its own APR.

- Rates Can Fluctuate: APR changes based on the market, so expect ups and downs.

- Flexibility: Pick your crypto and your earning level — there’s choice.

APR is an essential number for anyone using loans or investing. It’s an annual percentage showing what you could earn or pay in a year. In crypto, APR helps you gauge returns from staking, liquidity farming, or other passive income streams.

Why does APR matter? It helps you make smarter money moves. Planning to stake crypto? APR gives a rough idea of what you might earn if your funds stay in for a year. Higher APR = more potential profit, but usually higher risk too.

Who needs APR? Investors who want to earn from their assets. Crypto stakers, liquidity farmers, and project holders use it to check potential gains. It’s also handy for anyone using loans or interest-based products to see the cost of borrowing.

In short, APR is a go-to tool for calculating earnings and costs. It helps you navigate crypto and finance, keeps things clear, and helps avoid nasty surprises from interest rates.