L2 Withdrawal Guide: Time, Cost & The Hidden L1 Gas Fee Explained

Everyone raves about Layer 2 speed. Nobody tells you how tricky it is to get back out. Learn where the fees hide and why your “Withdraw” might be stuck for a week.

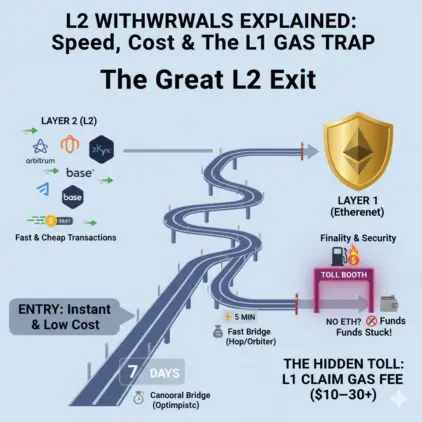

The world of Ethereum scaling has transformed rapidly, offering users faster and cheaper transactions through Layer 2 (L2) solutions such as Arbitrum, Optimism, zkSync, and Base. If you’re already fed up with confusing withdrawal times, hidden fees, and searching for a clear L2 exit strategy, you’ve landed on the right page. These Rollups drastically reduce fees and congestion on the Ethereum Mainnet (L1), but when it’s time to withdraw funds back to L1 or a centralized exchange (CEX), users often encounter delays, unexpected gas fees, and confusing steps.

This guide will cut through the noise. It will help you navigate the withdrawal process, understand why it’s designed this way, and choose the most efficient and cost-effective path for your funds, guaranteeing you’re never caught off guard by the L1 Claim Gas Fee again.

Section I: Why Is Withdrawing from Layer 2 So Complicated?

At first glance, it may seem strange that moving assets onto a Layer 2 network is almost instant, while moving them off again can take hours or even days. The reason lies in the architecture of Ethereum’s scaling model and how security guarantees are enforced between layers.

Every Rollup — whether it’s an Optimistic Rollup like Arbitrum or Optimism, or a ZK-Rollup like zkSync or Starknet — ultimately depends on Ethereum L1 as its final settlement and security layer. Layer 2 networks bundle hundreds or thousands of transactions into a single compressed batch, which is then posted to Ethereum for verification. This process makes transactions cheap and fast on L2, but it also introduces complexity when funds need to return to L1.

When you perform a simple token transfer between two wallets on the same Layer 2, everything happens inside that rollup’s own environment. The transaction doesn’t need to wait for Ethereum’s confirmation — only for the L2 sequencer to validate it. But when you withdraw from L2 to L1, you’re essentially asking Ethereum to recognize and confirm that your funds are legitimate and finalized. This process is what makes the withdrawal slower and sometimes more expensive.

The key concept behind this is the balance between Security vs. Speed. Rollups were designed to inherit Ethereum’s security, meaning that any movement of assets back to the mainnet must go through Ethereum’s consensus rules. This ensures that no fraudulent or invalid transaction can escape an L2 network. However, it also means that withdrawals cannot be instant — they must allow time for fraud proofs or validity proofs to be verified on L1.

For Optimistic Rollups like Arbitrum and Optimism, this is enforced through a standard 7-day challenge period. During these seven days, anyone can contest the transaction by submitting a Fraud Proof if they believe a malicious or incorrect state was posted. Only after this waiting period does Ethereum consider the withdrawal final. This waiting window is what frustrates most new users — their funds appear “stuck” for a week, even though everything is working as intended.

By contrast, ZK-Rollups such as zkSync or Starknet use a different mechanism. Instead of assuming transactions are valid until proven otherwise, ZK systems generate mathematical validity proofs that instantly confirm whether a batch of transactions is correct. This means that withdrawals can be finalized in a few hours rather than days. The trade-off, however, is that the process of generating these cryptographic proofs (known as Prover Costs) can be much more expensive, especially during high network congestion on Ethereum.

In short, withdrawing from Layer 2 is complicated because it involves not just moving tokens but also interacting with Ethereum’s security model. You’re not just transferring data; you’re requesting the Ethereum Mainnet to validate the legitimacy of your balance. This guarantees that your assets remain safe — but it comes at the price of extra time, higher gas fees, and the need for careful planning.

In the next section, we’ll explore the two main strategies available to every user: the Official (Canonical) Bridge provided by the L2 network itself and the Fast Bridge alternatives that allow instant withdrawals for a slightly higher cost.

Your ETH could be stuck for a week — and that’s not a bug. Rollups promise speed, but nobody warned you how painful it is to exit. This guide is your ticket back to L1 without losses.

The Official (Canonical) Bridge

The Canonical Bridge is the withdrawal route built directly into the Layer 2 protocol itself. When you use this method, your funds are transferred from L2 to L1 through the official smart contracts managed by the Rollup team. The process is slow but extremely secure because it relies entirely on Ethereum’s verification rules.

For Optimistic Rollups such as Arbitrum and Optimism, the Canonical Bridge involves the mandatory 7-day withdrawal window. During this period, your transaction is “in limbo” — it has been initiated on L2, but it won’t be finalized on Ethereum until the challenge period expires. This delay exists because these Rollups operate under the assumption that all transactions are valid unless proven fraudulent. The weeklong wait gives the network time to detect and respond to any invalid activity by submitting a Fraud Proof.

Using the Canonical Bridge is generally the lowest-cost method because you only pay L2 gas fees at the time of initiation. However, you must still pay a separate L1 Claim Gas Fee later to finalize your withdrawal on the Ethereum Mainnet — a step that often catches beginners off guard. We’ll discuss this hidden cost in detail in Section IV.

The main advantages of the Official Bridge are security and simplicity. You don’t rely on third parties or custodial intermediaries, and you know your funds are verified by Ethereum itself. The downside is, of course, time. Waiting seven days may be fine for long-term investors but frustrating for traders who need liquidity fast.

The Fast Bridge

To solve the problem of slow withdrawals, third-party solutions known as Fast Bridges (or “liquidity bridges”) emerged. Platforms like Hop Exchange, Orbiter Finance, and Synapse provide liquidity pools that allow users to instantly withdraw their tokens from L2 to L1 or even directly to a CEX wallet. These bridges effectively advance the user’s funds before the official withdrawal completes on-chain, taking on the risk themselves in exchange for a service fee.

The key difference is that Fast Bridges rely on liquidity providers and off-chain coordination. When you bridge your tokens using Hop, for example, you’re not moving your exact tokens immediately — instead, you receive equivalent tokens from a liquidity pool that’s already on the destination chain. The bridge later settles the “real” withdrawal through the Canonical Bridge in the background.

This method is significantly faster — often completing in 5 to 15 minutes — but it can be more expensive. Most Fast Bridges charge a combination of network gas plus a bridge fee or exchange fee, usually around 0.05–0.3% of the transaction amount. Despite the added cost, many users prefer Fast Bridges when speed is critical, such as during volatile market conditions or yield farming opportunities.

Another alternative under the same concept is withdrawing through a Centralized Exchange (CEX) that supports L2 deposits and withdrawals. For example, if Binance or Coinbase supports direct deposits from Arbitrum or Optimism, you can send your tokens to your exchange wallet and then withdraw to any other network supported by that CEX. This is technically a “Fast Bridge” route, as the exchange abstracts the bridging process behind its own liquidity.

To summarize, the choice between the Canonical Bridge and the Fast Bridge comes down to your priorities:

- If you want maximum security and can wait 7 days — use the Official Bridge.

- If you need instant liquidity and don’t mind paying a bit more — use a Fast Bridge like Hop or Orbiter.

- If you prioritize convenience and already use CEXs — deposit to your exchange wallet.

Both strategies are valid, and many experienced users combine them depending on circumstances. Next, we’ll compare the underlying economics between Optimistic Rollups and ZK-Rollups to understand why withdrawal costs vary so widely across networks.

Section III: Cost Breakdown: Why ZK-Rollups vs. Optimistic Rollups Matter

Understanding the differences in withdrawal costs between Optimistic Rollups and ZK-Rollups is crucial for planning your exit strategy. While both types of L2 networks aim to reduce transaction fees and improve speed, their underlying mechanisms create different cost structures and timelines.

Optimistic Rollups: Low Fees, Longer Wait

For Optimistic Rollups such as Arbitrum and Optimism, the main advantage is low transaction fees on Layer 2. Sending tokens, interacting with smart contracts, and initiating a withdrawal all require only a fraction of the gas you would pay on Ethereum L1. Typically, an L2 withdrawal costs between $5–$10 in L2 gas, depending on network congestion and token type.

However, the bottleneck for Optimistic Rollups is time. As explained in Section II, every withdrawal must pass through a mandatory 7-day challenge period. This period is required to allow anyone in the network to submit a Fraud Proof if they detect invalid transactions. Therefore, while your costs are minimal, you need to plan around this waiting period and ensure that you maintain some ETH on L1 to pay the final L1 Claim Gas Fee.

ZK-Rollups: Faster Withdrawals, Higher Costs

ZK-Rollups like zkSync and Starknet generate cryptographic validity proofs that confirm each transaction batch is mathematically correct before it reaches Ethereum L1. This allows withdrawals to finalize within hours instead of days.

The trade-off for speed is cost. Generating a validity proof requires computation on specialized off-chain infrastructure, referred to as Prover Cost. During periods of heavy network activity, this cost can spike, sometimes exceeding $20–$50 per withdrawal. Additionally, you must still pay the L1 gas fee to claim your funds on Ethereum Mainnet.

Section IV: The Hidden Cost: Understanding the L1 “Claim” Gas Fee

Even after your L2 withdrawal is fully processed, the final step requires interacting with Ethereum Mainnet to “claim” your funds. This step requires paying a gas fee in ETH, typically ranging from $10–$30.

- Reserve ETH on L1: Always leave a small amount of ETH to cover the claim.

- Monitor Gas Prices: Use tools like Etherscan Gas Tracker for cheaper claim periods.

- Consider CEX Withdrawal: Centralized exchanges can abstract the claim process.

- Bundle Claims: Some users claim multiple withdrawals together to save gas.

Section V: Practical Exit Matrix: How to Choose the Best Route

Now that we have examined withdrawal mechanics, costs, and hidden fees, it’s time to provide a clear framework for deciding how to exit L2 networks based on priorities: speed, cost, or security.

- If speed is your priority: Use a Fast Bridge or withdraw directly to a CEX. Higher fees but almost instant access.

- If cost-efficiency is your priority: Use the Canonical Bridge. Wait 7 days but minimal L2 gas and standard L1 fees.

- If security is your priority: Use the Official Bridge and ensure ETH reserved for claiming.

Table 1: Withdrawal Method Comparison

| Method | Time to Exit | Cost | Security |

|---|---|---|---|

| Official Bridge (Canonical) | Optimistic Rollups: 7 days | ZK-Rollups: Hours | L2 Gas + L1 Claim Fee ($10–$30) | Maximum — validated by Ethereum |

| Fast Bridge (Hop, Orbiter, CEX) | Minutes (5–15 min) | Bridge Fee 0.05–0.3% + L1 Gas | Depends on provider — trust required |

Table 2: L2/ZK-Rollup Specifics (2025 Data)

| Network | Rollup Type | Withdrawal Time | Typical Withdrawal Cost |

|---|---|---|---|

| Arbitrum | Optimistic | 7 days (Canonical), Minutes (Fast Bridge) | $5–$10 L2 Gas + $10–$30 L1 Claim |

| Optimism | Optimistic | 7 days (Canonical), Minutes (Fast Bridge) | $5–$10 L2 Gas + $10–$30 L1 Claim |

| zkSync | ZK-Rollup | Hours (Canonical), Minutes (Fast Bridge) | $20–$50 Prover Cost + $10–$30 L1 Claim |

| Starknet | ZK-Rollup | Hours (Canonical), Minutes (Fast Bridge) | $20–$50 Prover Cost + $10–$30 L1 Claim |

FAQs & Common Mistakes

FAQ 1: Why do I have to pay a fee on L1 when my funds are already on L2?

Answer: The L1 fee covers the final “claim” transaction that moves your funds onto Ethereum Mainnet. L2 only tracks balances internally until this step is completed. This L1 fee is mandatory.

FAQ 2: Can I withdraw directly from Arbitrum to my Coinbase wallet in 5 minutes?

Answer: Yes, if you use a Fast Bridge or a CEX supporting Arbitrum deposits. Expect higher fees than the Official Bridge.

FAQ 3: I waited 7 days, but my transaction failed. Why?

Answer: Common causes: spike in L1 gas or missing L1 claim transaction. Monitor ETH gas and reserve funds.

Common Mistakes to Avoid

- Not leaving ETH on L1 for the final claim — leads to “stuck” withdrawals.

- Confusing a swap on a DEX with a secure withdrawal via a bridge.

- Ignoring network congestion — L1 gas and L2 proof costs fluctuate.

- Assuming Fast Bridges are risk-free — trust in third-party liquidity is required.

Disclaimer

The information in this guide is for educational purposes only and does not constitute financial advice. Cryptocurrency transactions involve risk, including potential loss of funds. Users should research and consider professional consultation before making financial decisions. Always double-check addresses, gas fees, and withdrawal steps to avoid errors.

Thought exiting L2 was as simple as hitting “Withdraw”? Think again. Welcome to the world of hidden fees, delays, and surprises exchanges never warn you about. This guide shows you how to get out of Rollups pain-free.