L2 Showdown: ZK vs Optimistic Rollups Dialogue

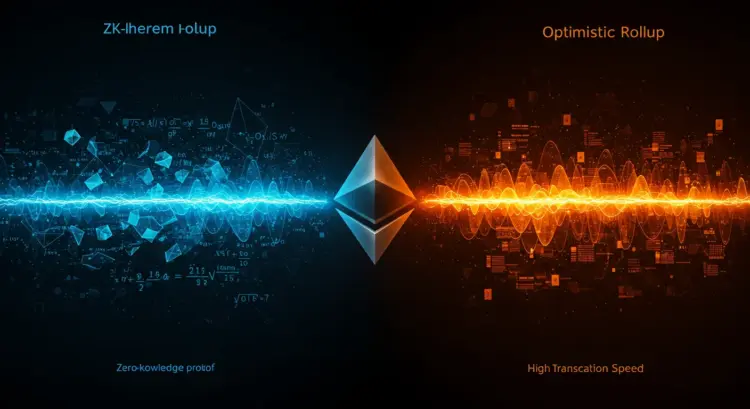

The L2 Scalability Showdown: ZK-Rollups vs. Optimistic Rollups

AVA (DeFi Strategist): Liam, let’s be honest — the scalability trilemma isn’t just theoretical anymore. Ethereum’s base layer is congested, gas fees are brutal, and users are fleeing to L2s. But the real question is: which L2 architecture actually scales without breaking the user experience?

LIAM (Architect): That’s exactly the tension. We’re stuck between *speed* and *certainty*. Optimistic Rollups like Arbitrum and Optimism prioritize throughput, but they rely on assumptions — assumptions that can be exploited. ZK-Rollups, on the other hand, offer cryptographic finality. No waiting, no trust — just math.

AVA: Sure, but math doesn’t onboard users. Look at the adoption curve. Optimistic chains dominate DeFi volume right now. Why? Because they’re fast, cheap, and familiar. Developers don’t need to rewrite contracts for a new ZK-EVM Type 2 vs Type 3 performance paradigm. They just deploy and go.

LIAM: And they inherit the risks. The Sequencer centralization problem is real. Most Optimistic Rollups rely on a single entity to order transactions. That’s a bottleneck — and a point of failure. If the sequencer crashes, or worse, colludes, users are exposed. The *data availability problem* becomes existential.

AVA: But decentralizing the sequencer isn’t trivial for ZK either. You still need coordination, and the cost of running a ZK prover is non-trivial. Not every validator can handle the overhead of generating zk-proofs for arbitrary EVM opcodes. That’s why we’re seeing hybrid models emerge.

LIAM: True, but let’s not conflate complexity with compromise. ZK-Rollups are built for long-term resilience. They don’t rely on fraud detection — they prevent fraud outright. Optimistic chains assume honesty and challenge dishonesty. That’s a reactive model. And the infamous 7-day withdrawal challenge period? It’s a UX nightmare.

AVA: It’s not ideal, but it’s improving. Arbitrum’s AnyTrust and Optimism’s Bedrock are pushing toward faster exits. Plus, the economics of fraud proof submission are evolving. Watchtowers and bonding mechanisms are mitigating risk. The role of L1 watchtowers is becoming more automated and less burdensome.

LIAM: But automation doesn’t eliminate latency. During L1 congestion, the fraud proof submission latency spikes. That’s not just a theoretical flaw — it’s a real vulnerability. Attackers can exploit L1 delays to suppress fraud proofs. And let’s not forget the risk of Sequencer crash recovery. There’s no standardized protocol for that yet.

AVA: So what’s your alternative? Wait for perfect ZK tooling while users suffer on L1? We need solutions now. Optimistic Rollups aren’t perfect, but they’re battle-tested. They’ve survived market stress, MEV attacks, and high-frequency trading loads. That counts for something.

LIAM: I’m not dismissing their utility. But we must be honest about their assumptions. Optimistic security is probabilistic. ZK is deterministic. If we’re building infrastructure for the next decade — for real financial sovereignty — we need guarantees, not guesses.

AVA: You’re right about assumptions — but assumptions are everywhere. Even ZK relies on trusted setups, cryptographic primitives, and proving systems that aren’t fully standardized. The economic incentives for submitting fraud proofs on Optimism may be imperfect, but they’re transparent. Users understand the model. With ZK, most don’t even know what a SNARK is.

LIAM: That’s a UX problem, not a protocol flaw. The math behind validity proof generation time is improving. And once we reach scalable recursion, the cost of verifying thousands of transactions collapses. The future isn’t just fast — it’s verifiable. Optimistic chains still rely on *soft finality*. That’s dangerous for high-value DeFi.

AVA: But DeFi isn’t the only use case. Gaming, social apps, microtransactions — they need speed, not cryptographic purity. Optimistic Rollups offer *instant execution* and *low fees*. ZK can’t match that yet. The cost per transaction ZK vs Optimistic still favors Optimistic by a wide margin.

LIAM: Temporarily. Once proving cost optimization kicks in, ZK will scale horizontally. And don’t forget the risk of mitigating DOS attacks during the 7-day challenge period. That window is a liability. Attackers can spam the network, delay exits, and exploit latency. ZK doesn’t have that surface.

AVA: And yet, users stay. Arbitrum and Optimism have real traction. They’ve passed audits, survived exploits, and built thriving ecosystems. The DeFi liquidation protection on Arbitrum vs zkSync is a good example — Optimistic chains are more battle-tested in volatile markets.

LIAM: That’s fair. But we’re talking about architecture, not adoption. The impact of L1 congestion on L2 fraud proof submission latency is a systemic flaw. It’s not just about UX — it’s about security guarantees. ZK-Rollups offer *deterministic finality*. That’s the foundation for trustless finance.

AVA: So we agree on the trade-off: Optimistic for speed and adoption, ZK for certainty and long-term integrity. But the market doesn’t wait for purity. It moves where liquidity flows. And right now, that flow favors Optimistic.

LIAM: True. But architecture wins in the long run. And the next segment of this debate — the cryptographic depth of ZK — is where things get serious.

LIAM (Architect): Let’s shift to the cryptographic side. ZK-Rollups aren’t just secure — they’re elegant. The use of SNARKs vs STARKs in L2 defines the future of scalable verification. STARKs offer transparency and post-quantum safety, but SNARKs are more compact and efficient for current EVM workloads.

AVA (DeFi Strategist): Compact, yes — but expensive. The validity proof generation time for SNARKs still creates bottlenecks. And the overhead of generating zk-proofs for arbitrary EVM opcodes is brutal. Developers face real friction when porting contracts. That’s why ZK-EVM Type 2 vs Type 3 performance matters — Type 2 is compatible but slow, Type 3 is fast but limited.

LIAM: That’s where recursion comes in. With Recursion in ZK-SNARKs for L2 scaling, we can batch thousands of transactions into a single proof. Verification becomes linear, and the cost drops dramatically. It’s not just theoretical — Scroll and Polygon are already testing recursive circuits in production.

AVA: But proving isn’t the only cost. Data availability is still a bottleneck. The cost analysis of L2 data availability via Calldata vs Blob storage shows that Calldata is inefficient. That’s why EIP-4844 Blob storage is such a game-changer. It slashes fees and unlocks throughput for both ZK and Optimistic chains.

LIAM: Agreed. Proto-Danksharding changes the economics. But ZK benefits more. With KZG commitment scheme implementation in danksharding, we get compact proofs and efficient aggregation. That’s critical for scaling without sacrificing integrity.

AVA: Still, the infrastructure isn’t ready for mass adoption. Running a full ZK node requires serious hardware. Most users rely on light clients. And the full node vs light client L2 setup creates asymmetry in verification. Optimistic chains, by contrast, are easier to bootstrap and monitor.

LIAM: But easier doesn’t mean safer. The Cross-Chain Composability risks are amplified when bridges rely on optimistic assumptions. ZK bridges offer *instant finality* and *cryptographic guarantees*. That’s why the L2 bridge finality times for small transactions are lower on ZK chains.

AVA: Yet most DeFi users don’t care about finality — they care about speed and liquidity. The L2 native yield solutions vs L1 staking returns are driving capital into Optimistic chains. And for high-frequency bots, optimizing transaction speed for high-frequency L2 trading bots is easier on Arbitrum than on zkSync.

LIAM: That’s a short-term view. Long-term, protecting against MEV and censorship matters more. The move toward decentralized sequencers is critical. ZK-Rollups can integrate sequencing with proof generation, reducing attack surfaces. That’s how we build resilient infrastructure.

AVA: So we’re back to trade-offs. ZK offers purity and security, but demands complexity. Optimistic offers speed and adoption, but accepts risk. The future isn’t binary — it’s modular. Use-case defines architecture.

LIAM: Exactly. For high-value DeFi, ZK is the path forward. For gaming, social, and low-risk apps, Optimistic chains are sufficient. The debate isn’t over — it’s evolving.

LIAM (Architect): So we’ve mapped the terrain. ZK-Rollups offer deterministic security, cryptographic finality, and long-term resilience. Optimistic Rollups deliver speed, adoption, and developer familiarity. The architecture must match the application.

AVA (DeFi Strategist): Exactly. For high-value DeFi, where finality and MEV resistance are critical, ZK is the right choice. For gaming, social, and low-risk consumer apps, Optimistic chains offer better UX and faster onboarding. The future isn’t about choosing sides — it’s about modularity.

LIAM: Then we agree: Ethereum’s scalability will be layered, not monolithic. ZK and Optimistic will coexist, each serving distinct needs. The challenge now is educating users and developers to choose wisely.

AVA: And building infrastructure that lets them switch seamlessly. Bridges, sequencers, and data layers must evolve. But the foundation is clear — scalability is no longer optional. It’s the prerequisite for Ethereum’s next chapter.

| Feature | ZK-Rollups | Optimistic Rollups |

|---|---|---|

| Security Model | Validity proofs (deterministic) | Fraud proofs (probabilistic) |

| Finality | Immediate (once proof is verified) | Delayed (subject to 7-day challenge period) |

| Proving Cost | High (but decreasing via Recursion in ZK-SNARKs) | Low (no proof generation required) |

| Developer UX | Complex (ZK-EVM Type 2 vs Type 3 performance) | Simple (EVM-compatible) |

| Sequencer Risk | Lower (can be decentralized with proof integration) | Higher (Sequencer centralization concerns) |

| Bridge Security | Cryptographic finality | Subject to fraud proof latency |

| Best Use Cases | High-value DeFi, MEV-sensitive apps | Gaming, social, low-risk consumer apps |

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, tax, or investment advice. Always conduct your own research (DYOR) and consult a qualified professional before making investment decisions. Layer 2 technologies involve complex trade-offs, and both ZK and Optimistic architectures carry unique risks related to security, latency, and infrastructure maturity.