FOMO & FUD in Crypto: Stop Buying Tops & Selling Bottoms

The FOMO-FUD Cycle Explained: How to Stop Buying the Top and Selling the Bottom

Introduction: The 90% Problem

Let’s face it — crypto isn’t a game of charts and luck. It’s a psychological battlefield where 90% of retail traders lose not because they lack skill, but because they let emotions dictate every move. Behind every wild pump or flash crash, there’s a silent war between whales who manipulate and ordinary investors reacting in fear or greed.

In this market, two invisible hands push the crowd like puppets: FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt). These forces aren’t natural market behaviors — they’re weapons of influence. Whales spread FUD to buy cheap, and they ignite FOMO to sell high. Every “to the moon” meme or “crypto is dead” headline serves a purpose: transfer your wealth into their wallets.

Think about it — how many times have you sold during a crash, only to watch the market recover days later? Or bought into a soaring coin right before the dump? That cycle isn’t random bad luck; it’s engineered by market psychology and manipulation tactics.

Here’s the ugly truth: emotional trading is predictable. Algorithms, bots, and professional traders already know how the average retail investor reacts. When the crowd panics, they accumulate. When the crowd rejoices, they distribute. Understanding this is the first step toward escaping the trap.

This guide isn’t about theory — it’s about reclaiming your control. You’ll learn to spot when fear is planted, when greed is being baited, and how to build a rules-based defense system that protects you from emotional sabotage. We’ll dissect both sides — FUD as the weapon of fear and FOMO as the trap of greed — then map out how the cycle repeats endlessly, draining unprepared traders.

But there’s good news: once you see the pattern, you can’t unsee it. The market’s emotional waves become signals instead of threats. You’ll start recognizing manipulation not as danger, but as opportunity — because panic creates entry points, and hype creates exits.

In the following sections, we’ll break down exactly how whales craft FUD to drive prices down, how FOMO makes you chase tops, and how to dismantle both forces using data, discipline, and self-awareness. The ultimate goal is simple: stop buying the top and selling the bottom.

I. Deconstructing FUD: The Whales’ Weapon

FUD — short for Fear, Uncertainty, and Doubt — is the oldest trick in the financial playbook. In crypto, it’s used like a scalpel: precise, intentional, and deadly effective. When you see panic headlines or “breaking news” about some new regulation or exchange insolvency, stop and ask: who benefits if I sell?

The uncomfortable truth is that FUD is engineered. It’s not a spontaneous burst of fear; it’s a deliberate campaign to drive prices down so that whales, institutions, and insiders can accumulate your coins at a discount. Once the panic fades and retail has dumped their bags, the same players flip sentiment — and the next rally begins.

To understand how manipulation works, you need to see FUD as a system. It follows a pattern: first comes narrative injection — negative rumors or regulatory warnings spread fast across crypto media. Then comes amplification — social media bots and influencers repeat it until the crowd internalizes the fear. Finally, execution — whales buy during your panic.

This process has been replayed countless times. In 2017, when China announced a “ban” on Bitcoin trading, headlines screamed collapse — BTC briefly fell 30%, only to recover within weeks. In 2021, “Environmental FUD” about mining sent retail fleeing while institutions bought the dip. In every case, the market didn’t change — sentiment did.

Three Major Types of FUD

1. Regulatory FUD: Stories about governments “banning crypto” or introducing harsh new laws. Often these announcements are misinterpreted or partial. For example, a proposed framework becomes a “ban” overnight. The crowd sells, and patient investors quietly buy.

2. Security FUD: Hack rumors, “exchange withdrawals suspended,” or claims that a blockchain is compromised. Even if true, scale and impact are usually exaggerated. Whales use the chaos to accumulate before the fix is public.

3. Economic FUD: Broader fear linked to inflation, rate hikes, or global markets. Crypto gets scapegoated as “risk-on,” so traders panic. But smart capital knows that when fear dominates headlines, the real bottom forms.

Why It Works So Well

Human brains are wired for survival, not markets. Fear triggers instant reaction — sell now, think later. FUD hijacks that instinct. Each “scare event” drains confidence from small investors, while professionals with data and liquidity quietly step in. It’s not about evil masterminds; it’s about understanding that information asymmetry drives profit.

The next time you see FUD spreading — SEC rumors, exchange solvency questions, or viral posts about “the end of crypto” — pause. Ask yourself: has the actual blockchain stopped working? Has the technology failed? Usually, it hasn’t. What’s broken is the public’s emotional stability — and that’s where opportunity hides.

Countering FUD requires discipline, not denial. Start by verifying sources before reacting. Go to official statements, on-chain data, or primary reports instead of influencers. Second, use the Fear and Greed Index as a sentiment compass: when fear peaks, whales prepare for reversal. Finally, remember that panic selling is voluntary — you can simply choose not to play their game.

FUD is powerful only when you let it steer your hand. Once you learn to detach emotion from information, it becomes a trading signal instead of a trap. In other words, fear becomes your data point, not your decision-maker.

II. Deconstructing FOMO: The Regret Trap

FOMO — Fear of Missing Out — is the twin sibling of FUD. If FUD drives you to sell too soon, FOMO drives you to buy too late. Both are fueled by emotion, not analysis. The tragedy is that most traders swing between them like a pendulum, always on the wrong side of sentiment.

In crypto, FOMO feels like excitement dressed as logic. You see charts going vertical, influencers posting screenshots of their gains, and headlines screaming “new all-time high.” Your rational brain whispers caution, but your dopamine system shouts louder: buy before it’s too late! That’s when you make your worst decisions.

Why FOMO Is So Addictive

Humans are social creatures. We crave belonging and fear exclusion. When the crowd celebrates profits, missing out feels like punishment. That emotional pain activates the same neural circuits as physical injury. It’s not about greed — it’s about avoiding the pain of regret.

Traders often mistake that emotional urgency for opportunity. They chase green candles, thinking they’re joining early momentum. In reality, they’re liquidity for the smart money exiting. By the time retail buyers enter, insiders are already taking profits. Every cycle proves it: by the time it’s trending, it’s too late.

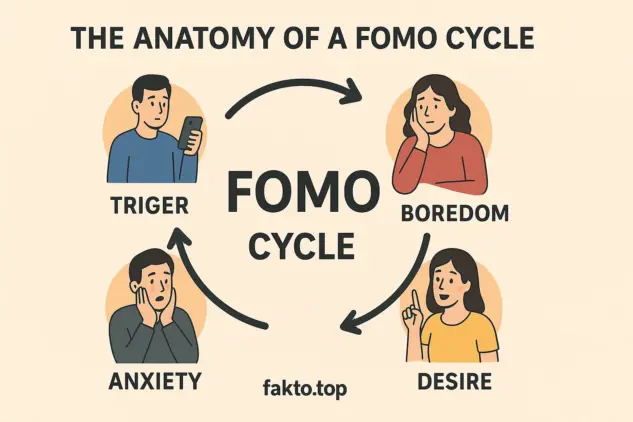

The Anatomy of a FOMO Cycle

The cycle starts with quiet accumulation. Early believers or insiders buy at low prices while the project is under the radar. Then comes the first breakout — prices double or triple, media coverage begins, and influencers notice. That’s when FOMO ignites.

At the peak of euphoria, everyone believes they’ve discovered a “sure thing.” Telegram channels overflow with rocket emojis and price targets. That’s the moment whales start distributing their holdings. Soon after, volatility spikes, late buyers panic, and the market corrects sharply. In the aftermath, the same crowd swears they’ll “never chase again”… until the next hype wave.

Social Amplification: How FOMO Goes Viral

Crypto communities amplify emotion faster than any traditional market. X (formerly Twitter), Reddit, and Telegram act like neural networks for hype. One viral post can trigger thousands of impulsive buys within hours. Algorithms reward excitement, not truth, so FOMO content always trends higher than sober analysis.

Even developers and founders aren’t immune. They start believing their own narratives, making promises to sustain momentum. That’s when overvaluation begins — and when disillusionment inevitably follows.

Turning FOMO Into an Edge

Escaping the FOMO trap doesn’t mean ignoring trends — it means understanding timing. True professionals wait for confirmation: they analyze volume, liquidity, and macro context before acting. They know that patience pays more than speed.

The secret is reframing emotion into signal. When you feel the urge to “ape in,” that feeling itself is a warning flag. It tells you the crowd is already committed, and risk is high. The smart move is often to wait for the inevitable retrace, not chase the runaway train.

FOMO isn’t just a feeling — it’s data about where sentiment stands. When you sense euphoria, start preparing for exit, not entry. When you sense silence, start researching. The best entries always happen when nobody is watching.

Once you learn that regret is not a market signal, you stop being the product. You stop feeding the cycle — and start profiting from it.

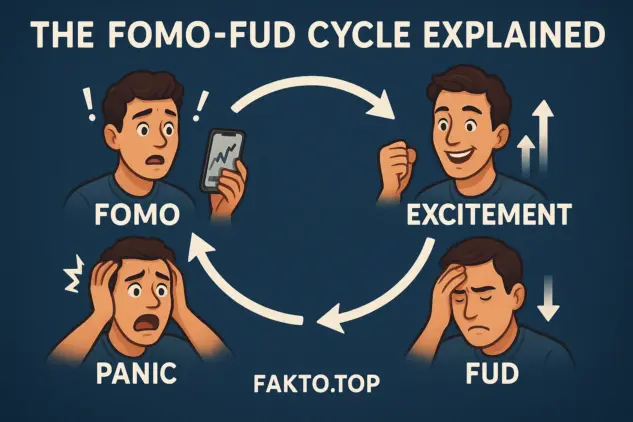

III. Visualizing the Engine: The FOMO-FUD Spiral

Now that we understand FUD and FOMO individually, it’s time to see how they form a self-reinforcing spiral that drives crypto markets. Prices don’t rise or fall randomly — they move in predictable waves of fear and greed.

Imagine a cycle: FUD hits first. Negative news spreads — “regulation crackdown,” “exchange hacked,” “crypto bubble burst.” Retail traders panic and sell, triggering a price dip. Meanwhile, insiders quietly accumulate. This is the quiet phase of the spiral, where opportunity meets patience.

As accumulation progresses, small recoveries appear. Prices begin to climb slowly, signaling the first signs of hope. Early adopters start posting gains. That’s the seed of FOMO: a few successful trades trigger social proof. Then the crowd notices the rally, and momentum accelerates — a classic “FOMO-fueled impulse buy.”

The Cycle in Action

- FUD hits: Negative sentiment spreads, retail sells in panic.

- Smart money accumulates: Whales and institutions buy quietly at discounted prices.

- Price begins to rise: Early movers gain confidence, creating a feedback loop.

- FOMO ignites: Social media hype, trending charts, and fear of missing out drive late buyers.

- Distribution phase: Whales sell to FOMO buyers, locking in profits.

- New FUD triggers: Fear returns, retail sells, and the cycle resets.

This loop explains why markets feel so volatile. Every “pump” has a preceding “dip,” and every crash follows hype. Understanding the spiral is the first step toward mastering it. Traders who ignore it become fuel for the cycle; those who recognize it can anticipate opportunities.

Linking to Metrics: Fear and Greed Index

The Fear and Greed Index is a practical tool to visualize this cycle. Extreme fear aligns with panic selling (FUD) — often the best time to buy. Extreme greed aligns with FOMO peaks — often the best time to take profits or wait. By tracking these metrics alongside your plan, you can convert emotional chaos into structured opportunity.

Why This Spiral Repeats

Humans are predictable. Fear and greed dominate behavior across all markets, and crypto amplifies both due to high volatility and 24/7 news cycles. Algorithms and social media accelerate these emotions. Every whale knows the pattern, and every retail trader unknowingly reinforces it. Once you internalize the spiral, you stop reacting blindly and start positioning strategically.

In short, the FOMO-FUD spiral is emotional arbitrage. Knowledge of the cycle lets you anticipate peaks and troughs, reduce risk, and convert psychological pressure into tactical advantage.

IV. The Defense: 5 Rules to Master Your Crypto Mindset

Now that we understand how FUD and FOMO operate, the next step is building a defense. The goal is simple: replace emotion with rules-based trading. This section outlines five actionable rules to protect your capital and mindset.

Rule #1: Define Your Plan — Then Obey It

Every trade should start with a plan. Define your entry points, exit points, maximum risk, and profit targets. Write it down and treat it as law. A plan removes emotion from decision-making. When you see a sudden dip, you act according to your strategy, not panic.

Rule #2: Automate Discipline with Dollar-Cost Averaging (DCA)

DCA is your best friend against FOMO. By investing a fixed amount regularly, you remove timing guesswork. Price spikes or dips become irrelevant — your average cost smooths out, and emotional buying is minimized. This approach also allows you to buy during FUD-induced dips with less stress.

Rule #3: Protect Capital with Stop-Loss Orders

Stop-loss orders are not signs of weakness — they’re shields. Predefine the point where a position becomes unacceptable. Without this, fear can spiral, leading to getting rekt. With stop-loss, you maintain control, preserve capital, and prevent emotional decision-making from ruining your plan.

Rule #4: Track Emotional Bias

Maintain a trading journal. Note when emotions like greed, fear, or envy drive your impulses. Awareness alone can break the feedback loop. Emotional tracking converts chaos into data: your reactions become measurable and improvable over time.

Rule #5: DYOR — Always

Do Your Own Research (DYOR) is critical. Don’t buy a coin just because influencers hype it. Evaluate fundamentals, tokenomics, development roadmap, and community engagement. Independent analysis shields you from FUD-driven panic and FOMO-driven overbuying.

| Emotion/Trigger | Instinctive Action | Rational Response | Result of Discipline |

|---|---|---|---|

| Regulatory FUD | Panic sell | Check official sources and fundamentals | Opportunity to accumulate at lower prices |

| Market Pump | Impulse buy | Wait for retracement or technical confirmation | Avoid buying the top |

| Social Media Hype | Chase trend | Verify project credibility and fundamentals | Enter only on value, not hype |

| Price Crash | Sell in fear | DCA or rebalance portfolio | Reduce average cost and long-term risk |

Following these five rules consistently allows you to navigate volatile markets without being manipulated by emotion. The combination of planning, automation, protection, emotional awareness, and research transforms FUD and FOMO from threats into signals. When implemented correctly, discipline becomes your competitive advantage.

V. Real-World Case Study: Learning from the Hype

Let’s bring theory to life. Consider the **Dogecoin peak of 2021**. Early adopters quietly accumulated DOGE when it was under a dollar. Social media hype, memes, and celebrity tweets ignited FOMO among retail traders. Prices skyrocketed from $0.05 to $0.70 in months. Late buyers entered at the peak, only to watch prices drop dramatically afterwards.

Meanwhile, FUD hit intermittently — regulatory rumors and Elon Musk-related controversies spooked traders multiple times. Those who panicked sold early and missed the next rally. Those who understood the cycle and applied a DCA strategy navigated the volatility successfully, avoiding emotional overreaction.

Another example is the **Terra Luna collapse**. FUD spread rapidly as algorithmic stablecoin concerns escalated. Many retail traders sold in panic, amplifying losses. Traders with rules-based strategies, stop-losses, and a focus on fundamentals survived or minimized damage. In both cases, emotions dictated the outcomes for the majority, while disciplined systems created resilience.

Key Takeaways

- FUD and FOMO are predictable psychological forces — not random luck.

- Smart money exploits these forces to accumulate cheaply and sell high.

- Rules-based strategies like DCA, stop-losses, and emotional tracking protect your portfolio.

- Understanding sentiment cycles turns potential losses into actionable signals.

Conclusion & Final Call to Action

The crypto market will continue to swing between fear and greed. Whales will manipulate, media will sensationalize, and social pressure will amplify emotion. You have two choices: react like the 90% who lose, or adopt a disciplined approach that lets you act rationally when others panic or chase.

Implement the five rules: define a plan, use DCA, employ stop-losses, track emotional bias, and always DYOR. Watch the Fear and Greed Index, and treat FUD and FOMO as signals, not commands. Remember, patience and discipline are more profitable than impulsive moves.

Take action today. Create your rules, stick to them, and stop being a victim of the cycle. By mastering the FOMO-FUD spiral, you finally stop buying the top and selling the bottom.

FAQ: Common Questions on FOMO and FUD

Q: Can institutions use FUD to their advantage?

A: Absolutely. FUD is often strategically spread to induce panic selling. Recognizing it as a manipulation tactic allows you to respond calmly and exploit opportunities.

Q: What is the opposite of FOMO?

A: FOBO (Fear of Better Options) or JOMO (Joy of Missing Out). Both involve disciplined restraint and can protect you from impulsive buying.

Q: I bought the top because of FOMO. What should I do now?

A: First, don’t panic. Analyze fundamentals and consider DCA or a staged exit. Avoid emotional liquidation — stick to a rational plan.

Q: How do I identify FUD in crypto news?

A: Check original sources, verify statements, and look for exaggeration or ambiguity. Ask who benefits if panic spreads.

Q: Is emotional trading inevitable?

A: Not if you implement rules-based strategies and consistently track your own behavior. Awareness plus planning neutralizes most emotional impulses.