Crypto On-Ramps in the US 2026: The Ultimate Guide to Instant Buys

The Definitive US Crypto On-Ramp Guide for 2026

The landscape of digital asset acquisition has fundamentally transformed, making a seamless US crypto on-ramp no longer a luxury, but a regulatory and technical standard. As we enter 2026, the integration of instant settlements and institutional-grade security has redefined how American capital enters the market. This guide provides the essential blueprint for navigating today’s streamlined financial gateways with maximum efficiency and total compliance.

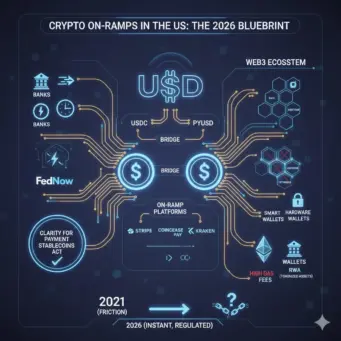

The Macro Shift — From Friction to Default (2021 vs 2026)

In 2021, buying crypto in the United States was an exercise in tolerance. Users dealt with delayed ACH settlements, random bank blocks, opaque spreads, and compliance rules that changed without notice. A simple USD-to-BTC purchase could take three to five business days and still fail at the final step. Crypto adoption grew despite the rails, not because of them.

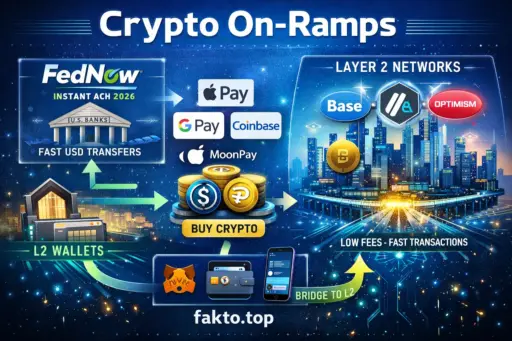

In 2026, the situation is reversed. Fiat-to-crypto conversion is no longer a niche workflow but a regulated financial primitive. FedNow instant settlement, real-time RTP rails, and regulated stablecoins have turned crypto on-ramps into a default banking extension. For most US users, buying USDC or ETH is now faster than initiating a domestic wire.

The single most important inflection point was the Clarity for Payment Stablecoins Act. This legislation did not “legalize crypto” in a broad sense. It explicitly legalized and standardized the USD-to-stablecoin pipeline, with USDC and PYUSD treated as regulated payment instruments. Once that happened, banks stopped seeing crypto on-ramps as counterparties of unknown risk.

Infographic of US crypto on-ramp landscape in 2026 showing FedNow

The effect was immediate. Major US banks moved from silent blocking to selective cooperation. FedNow transfers to compliant providers became routine. Instead of asking “is crypto allowed,” banks now ask “is this provider Clarity Act compliant.” The question shifted from ideology to plumbing.

Another overlooked change is user expectation. In 2021, retail investors accepted friction as the price of innovation. In 2026, they do not. A three-minute KYC delay feels slow. A rejected FedNow transfer triggers an instant switch to another bank. This behavioral pressure forced on-ramp providers to compete on reliability, not marketing.

The macro result is clear. Crypto in the US did not win by replacing banks. It won by integrating into the banking stack so deeply that the boundary disappeared. Stablecoins became the bridge asset, L2 networks became the default settlement layer, and instant fiat rails removed the psychological cost of entry.

Technical Infrastructure — How Fiat Actually Moves in 2026

FedNow and RTP Rails: Instant Settlement Without Exceptions

FedNow is not just “faster ACH.” It is a real-time gross settlement system that clears and settles transactions within seconds, 24/7. In a typical 2026 on-ramp flow, a user initiates a FedNow push from a supported bank, and the crypto provider receives final funds before the user closes the app. There is no pending state.

RTP rails operate similarly but are bank-network specific. Some providers prioritize RTP because of lower operational risk and better reconciliation tooling. Others default to FedNow due to broader institutional coverage. From the user’s perspective, both feel identical: instant confirmation and immediate purchasing power.

The critical detail is settlement finality. Once a FedNow transfer clears, it cannot be clawed back like ACH. This allows on-ramps to credit USDC or ETH instantly without prefunding risk. Providers that still rely on ACH in 2026 are doing so by choice, not necessity, and that choice costs users money.

Why Stablecoins Are the Native Output of Fiat Rails

In 2026, no serious on-ramp converts USD directly into volatile assets as a first step. The default output is USDC. This is not a UX decision but a liquidity optimization. Stablecoins allow providers to separate fiat settlement from market execution, reducing slippage and spread exposure.

Once USDC is minted or credited, conversion into BTC, ETH, or L2-native assets happens on crypto rails, not banking rails. This separation is why buying USDC first is consistently cheaper and faster. Users who insist on direct BTC purchases pay a convenience tax they rarely see itemized.

This infrastructure shift explains why “crypto on-ramps US 2026” looks more like payments engineering than brokerage onboarding. The rails are faster, the assets are regulated, and the remaining inefficiencies are almost always self-inflicted by legacy apps.

Technical Infrastructure — Deep Dive Into the 2026 Stack

Account Abstraction and ERC-4337: How Gasless On-Ramps Actually Work

By 2026, ERC-4337 is no longer a developer curiosity. It is the default account model for retail-facing wallets and on-ramp integrations. The key change is that users no longer manage externally owned accounts in the traditional sense. They interact with smart accounts that abstract away gas, nonce management, and transaction sequencing.

In a gasless on-ramp flow, the user never touches ETH for fees. A smart account is created or reactivated in the background, and transaction costs are sponsored by the on-ramp provider or bundled into the fiat purchase. From the user’s perspective, authentication happens via FaceID or passkeys, not seed phrases.

This is not cosmetic. ERC-4337 allows on-ramps to batch user operations, settle fees in USDC, and route transactions directly to L2 networks like Base or Arbitrum. The result is a fiat-to-L2 pipeline that feels indistinguishable from a traditional card payment but settles on-chain within seconds.

Security Model: Why Sponsored Gas Does Not Mean Sponsored Risk

One common misconception in 2026 is that gas sponsorship weakens self-custody. In reality, ERC-4337 improves it. Smart accounts enforce programmable policies such as spending limits, session keys, and recovery rules. Losing a phone no longer means losing funds, and this has materially reduced retail loss rates.

On-ramps leverage these features to offer non-custodial gateways with institutional-grade safety. The provider never controls the assets, but it can enforce compliance logic at the moment of funding. This balance is what regulators ultimately accepted.

Institutional Rails for Retail: Stripe, Circle, and Liquidity Normalization

The most important quiet change between 2023 and 2026 is who provides liquidity. Stripe and Circle effectively democratized institutional-grade access for retail flows. Stripe’s crypto APIs now connect directly to regulated stablecoin issuance and redemption, while Circle’s USDC liquidity bridge provides predictable pricing at scale.

This means that when a user buys USDC via Stripe or a Stripe-powered on-ramp, they are not interacting with a thin retail order book. They are accessing the same liquidity pools used by payment processors and fintech platforms. Spread compression is a direct result of this structural shift.

Circle’s role is particularly critical. As the primary issuer of USDC under Clarity Act compliance, Circle enforces redemption guarantees that banks understand. When a bank sees Circle on the other side of a FedNow transfer, the risk model changes completely.

Why L2 Is the Default Settlement Layer in 2026

Layer 2 networks are no longer an optimization. They are the default destination for retail fiat inflows. Base, Arbitrum, and Polygon handle the majority of new USDC issuance tied to consumer purchases. Mainnet Ethereum is used primarily for large-value transfers and institutional rebalancing.

For on-ramps, L2-native support reduces fees, increases success rates, and enables instant crediting. A Base network native buy can settle faster than a debit card authorization. Providers that still force mainnet settlement expose users to unnecessary delays and costs.

This infrastructure reality explains why the best way to buy crypto in USA in 2026 is rarely about brand. It is about which provider fully embraced FedNow, ERC-4337 smart accounts, and L2-native liquidity, and which ones are still pretending it is 2021.

The Big Seven Providers — Detailed, Opinionated Breakdown

Stripe

Stripe is not a consumer app, but in 2026 it is the backbone of many of the best crypto on-ramps in the US. When you use a “powered by Stripe” flow, you are accessing institutional liquidity with retail UX. Stripe’s advantage is reliability, not branding.

Fee Breakdown

Stripe-powered purchases typically show a low visible fee but embed a small spread at the USDC conversion layer. Total cost averages 0.6–0.9 percent on FedNow transfers. Network fees are almost always sponsored.

L2 Support

Native support for Base, Arbitrum, and Polygon is standard. Mainnet Ethereum is optional and usually discouraged for small purchases.

KYC Friction

Initial verification takes under three minutes for US residents using passkeys. Reverification is rare unless transaction patterns change.

Bank Compatibility

Works best with Chase, Bank of America, and SoFi. Regional banks have higher rejection rates.

Coinbase Pay

Coinbase Pay is no longer just an exchange on-ramp. It functions as a universal payment layer for crypto apps. Its main strength is deep integration with self-custody wallets and predictable compliance behavior.

Fee Breakdown

Coinbase Pay charges a visible fixed fee plus a variable spread. Total cost is higher than Stripe, averaging 1.2–1.6 percent. Network fees on L2 are minimal.

L2 Support

Base is the default network, followed by Arbitrum and Optimism. Polygon support exists but is secondary.

KYC Friction

Verification is near-instant for existing Coinbase users. New users typically clear KYC within five minutes.

Bank Compatibility

Strong compatibility with Chase and Wells Fargo. Mixed results with credit unions.

MoonPay

MoonPay remains a global convenience on-ramp. In the US market, its value is reach rather than efficiency. It is widely supported but rarely the cheapest option.

Fee Breakdown

MoonPay uses a blended fee model with higher spreads. Total cost often exceeds 2 percent, especially on debit cards.

L2 Support

Supports Polygon and Arbitrum reliably. Base support exists but is not always native.

KYC Friction

Verification can take up to ten minutes and occasionally requires manual review.

Bank Compatibility

Better results with neo-banks like Chime. Traditional banks may flag transfers.

Transak

Transak positions itself as a compliance-first on-ramp. This makes it slower but predictable. It is favored by enterprise apps that prioritize regulatory clarity over price.

Fee Breakdown

Fees are transparent but higher, averaging 1.5–2 percent on bank transfers.

L2 Support

Strong Polygon and Arbitrum support. Limited Base integration.

KYC Friction

Expect a full five to eight minutes for verification.

Bank Compatibility

Compatible with most large US banks, including Citi and Wells Fargo.

Robinhood

Robinhood’s crypto on-ramp in 2026 is optimized for users already inside its ecosystem. It is fast, simple, and tightly controlled. The trade-off is limited flexibility and slower innovation on L2 support.

Fee Breakdown

Robinhood advertises zero fees, but revenue is generated through spread. Effective cost averages around 1 percent. Network fees are abstracted away.

L2 Support

Primarily Ethereum mainnet and Polygon. Base and Arbitrum support remains limited.

KYC Friction

Instant for existing brokerage users. New users face full identity checks.

Bank Compatibility

Excellent compatibility with major banks, including JPMorgan Chase and Wells Fargo.

Kraken

Kraken remains a power-user platform. Its on-ramp is robust but assumes some technical competence. It is not designed for casual buyers.

Fee Breakdown

Low spreads but visible fees. Total cost can be under 0.8 percent on FedNow transfers.

L2 Support

Strong Arbitrum and Optimism support. Base integration is improving.

KYC Friction

Verification typically completes in under five minutes.

Bank Compatibility

Best results with pro-crypto regional banks and fintechs.

Bitwage

Bitwage is not a traditional on-ramp but plays a critical role in fiat-to-crypto flows for freelancers and payroll users. It converts earned USD directly into crypto.

Fee Breakdown

Fees are low and predictable, often under 1 percent.

L2 Support

Supports Ethereum and select L2 networks for payouts.

KYC Friction

KYC is thorough but one-time.

Bank Compatibility

Works best with employer-linked accounts and compliant banks.

The Regional and Banking Landscape in the United States

Why Geography Still Matters in a “Federal” Crypto Market

In 2026, crypto regulation in the US is federally coherent but locally uneven. The Clarity for Payment Stablecoins Act standardized stablecoin issuance, not state-level licensing. As a result, the on-ramp experience still varies meaningfully depending on where the user lives and which bank holds their deposits.

The practical outcome is simple. Two users with identical income, transaction size, and compliance history can have radically different success rates when using the same crypto on-ramp. The difference is almost always geographic, not behavioral.

New York vs Texas vs Wyoming: A Reality Check

New York remains the most restrictive environment due to BitLicense enforcement. While most major on-ramps technically support New York residents, transaction limits are lower, and compliance triggers are more sensitive. FedNow transfers succeed, but secondary reviews are common for amounts above $10,000.

Texas and Wyoming represent the opposite extreme. Both states actively court crypto infrastructure providers, and banks operating there tend to treat compliant on-ramps as standard fintech counterparties. In these states, high-value FedNow or RTP transfers rarely trigger manual review.

California sits in the middle. Large banks operate smoothly, but regional institutions vary widely. Users in California benefit most from choosing national banks with dedicated crypto compliance teams.

The 2026 “Friendly Banks” List

JPMorgan Chase is the most reliable retail bank for crypto activity in 2026. Its internal JPM Coin infrastructure normalized digital asset settlement long before retail adoption caught up. Chase accounts have the lowest rejection rate for FedNow crypto transfers, especially to Stripe-powered providers.

BNY Mellon plays a different role. It is less visible to retail users but underpins custody and settlement for several major on-ramps. If an on-ramp advertises BNY Mellon custody, banks treat it as institutionally safe by default.

Among neo-banks, Revolut US stands out. It offers high approval rates for RTP and FedNow transfers and transparent transaction labeling. Chime is inconsistent, and SoFi performs well only for users with established account history.

Banks to Avoid for Crypto On-Ramps

In 2026, Wells Fargo remains unpredictable for crypto-related transfers despite public statements of support. Smaller regional banks without dedicated crypto compliance teams are the most likely to silently block FedNow pushes.

If a bank requires a phone call to approve a real-time payment, it is not crypto-friendly. Users serious about efficient fiat-to-L2 pipelines should not attempt to “train” a hostile bank. Switching accounts is faster.

Economic Optimization — Reducing Cost at Every Layer

The USDC-First Strategy Explained

The most reliable way to reduce costs when buying crypto in the US in 2026 is to buy USDC first. This approach consistently lowers total cost by up to 40 percent compared to direct BTC or ETH purchases. The reason is structural, not promotional.

Direct purchases bundle fiat settlement, asset conversion, and volatility risk into a single transaction. USDC purchases separate these steps. Fiat settles via FedNow, USDC is credited instantly, and asset conversion happens on crypto-native liquidity pools with tighter spreads.

Slippage, Spread, and “Fiat Leakage” in Convenience Apps

Apps like PayPal and Venmo offer crypto exposure but leak value through wide spreads and opaque pricing. Users pay for convenience without realizing the cumulative cost. On large purchases, this hidden leakage can exceed visible fees by a significant margin.

High-volume users should avoid any app that does not show a clear USDC balance or allow on-chain withdrawal. If you cannot move assets to a self-custody wallet, you are not using a true on-ramp.

High-Volume Entry: $50,000 and Above

For entries above $50,000, OTC desks outperform retail on-ramps in pricing but sacrifice speed. Wire transfers remain relevant at this scale, especially for BTC accumulation. However, FedNow-based USDC entry followed by L2 execution often matches OTC pricing with better flexibility.

Compliance, Security, and Tax Automation in 2026

CARF and Real-Time Tax Attribution

By 2026, CARF compliance is embedded directly into the on-ramp layer. This means tax-relevant metadata is generated at the moment of purchase, not reconstructed months later. Every compliant on-ramp tags fiat-to-crypto transactions with acquisition price, timestamp, and wallet attribution.

For the user, this eliminates ambiguity. When USDC or ETH hits a smart account, the cost basis is already locked and exportable. Platforms that do not offer CARF tax integration are functionally obsolete for US users with recurring activity.

Travel Rule 2.0: What Is Actually Shared

The Travel Rule threshold remains $3,000, but the data shared in 2026 is narrower and more standardized. On-ramps transmit sender identity, destination wallet type, and jurisdictional flags. They do not share full transaction history or wallet balances.

For self-custody users, this means privacy is preserved as long as the wallet is properly classified. Smart accounts created via ERC-4337 are now explicitly recognized as non-custodial endpoints, reducing friction.

Direct-to-Hardware Wallet On-Ramping

Ledger and Trezor integrations are native in most major on-ramps. In practice, this means a user can complete a FedNow transfer and receive USDC directly into a hardware-secured smart account. There is no intermediary custodial step.

This workflow is now considered best practice for high-value users. If an on-ramp cannot deliver funds directly to self-custody, it introduces unnecessary counterparty risk.

Use Cases — From Fiat to Real World Assets

In 2026, a significant portion of retail inflows are not aimed at speculative trading. Users increasingly buy crypto to access tokenized real world assets. USDC is the primary gateway into tokenized T-Bills, on-chain money market funds, and gold-backed tokens.

The on-ramp decision directly affects yield. Delays or excess fees reduce effective returns, especially for short-duration assets. This is why efficient fiat-to-L2 pipelines are now part of basic portfolio construction.

Master Tables and Practical Tools

| Provider | Fees | L2 Support | KYC Speed | Best Banks | Use Case |

|---|---|---|---|---|---|

| Stripe | Low | Base, Arbitrum | Fast | Chase | Best overall |

| Coinbase Pay | Medium | Base | Fast | Chase | Ecosystem users |

| MoonPay | High | Polygon | Medium | Chime | Convenience |

| Transak | Medium | Arbitrum | Slower | Citi | Compliance-first |

| Robinhood | Spread | Limited | Instant | JPM | Brokerage users |

| Kraken | Low | Arbitrum | Fast | Fintech banks | Power users |

| Bitwage | Low | Select L2 | One-time | Employer-linked | Payroll |

| Method | Speed | Cost |

|---|---|---|

| ACH | Slow | Low |

| FedNow | Instant | Lowest |

| Debit | Instant | High |

| Wire | Same-day | Medium |

| Network | Supported On-Ramps |

|---|---|

| Base | Stripe, Coinbase Pay |

| Arbitrum | Stripe, Kraken, Transak |

| Polygon | MoonPay, Robinhood |

The 5-Minute Compliance Audit for US Users

- Bank supports FedNow or RTP

- On-ramp offers USDC as default output

- ERC-4337 smart account supported

- CARF tax data export available

- Direct self-custody withdrawal enabled

FAQ: Real Problems, Direct Answers

What if my bank blocks a FedNow transfer? Switch banks. Chase and Revolut US resolve this instantly.

Is buying BTC directly ever optimal? Only for very small amounts where simplicity matters more than cost.

Do gasless on-ramps compromise custody? No. Smart accounts improve security.

Which on-ramp is cheapest? Stripe-powered flows with FedNow.

Can I avoid KYC? No, not legally in the US.

Are stablecoins safe in 2026? USDC is regulated and redeemable.

What about PayPal crypto? Avoid for serious usage.

How fast is tax reporting? Instant at purchase.

Is L2 mandatory? For cost efficiency, yes.

Best way to buy crypto in USA? FedNow → USDC → L2.

Disclaimer

This guide is intended for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency investments carry significant risk, including potential loss of principal. Users are responsible for conducting their own research and complying with local, state, and federal regulations. The author and providers mentioned in this guide are not liable for any financial decisions or outcomes resulting from the use of the information contained herein. Always consult a licensed financial or legal professional before making investment decisions.