Crypto APR Explained: Staking, Lending & Yield Farming Strategies

Understanding APR in Cryptocurrency: Mechanisms, Risks, and Strategic Applications

Annual Percentage Rate (APR) is a foundational metric in decentralized finance (DeFi), staking, and crypto lending. While often misunderstood or conflated with APY (Annual Percentage Yield), APR serves as a critical benchmark for evaluating yield, risk exposure, and protocol efficiency. This article provides a comprehensive analysis of APR in crypto markets, its implications for professional investors, and its evolving role in 2025–2026.

What Is APR in Crypto?

APR in cryptocurrency refers to the annualized rate of return offered by a protocol, platform, or smart contract, excluding compounding effects. It is commonly used in:

- DeFi lending platforms (e.g., Aave, Compound)

- Staking mechanisms (e.g., Ethereum 2.0 validators)

- Yield farming pools and liquidity provision

Unlike APY, which includes compound interest, APR provides a linear view of expected returns. For institutional and professional investors, APR is often preferred for modeling predictable cash flows and assessing protocol sustainability.

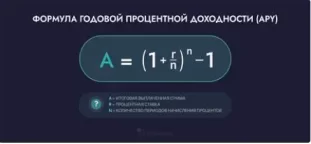

APR vs. APY: Key Differences

While both metrics aim to quantify yield, their calculation methods differ:

| Metric | Includes Compounding | Use Case | Typical Context |

|---|---|---|---|

| APR | No | Fixed-rate lending, staking | Protocol-level yield |

| APY | Yes | Auto-compounding vaults | Retail-focused DeFi |

APR is more transparent for comparing platforms, especially when compounding frequency varies or is user-controlled. It also aligns better with traditional finance models, making it suitable for cross-sector analysis.

How Is APR Calculated in DeFi?

APR is typically calculated using the following formula:

APR = (Interest Earned / Principal) × 365 / Days Active × 100%

However, in crypto, APR may also reflect:

- Token emissions (e.g., governance token rewards)

- Protocol fees redistributed to stakers

- Liquidity pool incentives

It is essential to distinguish between base APR and promotional APR. The latter often includes temporary boosts or token subsidies, which may not be sustainable long-term.

What Drives APR Volatility?

APR in crypto is not fixed. It fluctuates based on:

- Supply and demand dynamics within lending pools

- Protocol governance decisions (e.g., reward rate adjustments)

- Market volatility and token price fluctuations

- Liquidity migration between platforms

For example, during periods of high borrowing demand, lending APRs may spike. Conversely, when liquidity providers exit en masse, staking APRs may decline due to reduced reward distribution.

Strategic Use of APR in Portfolio Construction

Professional investors use APR to:

- Compare yield opportunities across protocols

- Model expected returns in multi-chain portfolios

- Assess risk-adjusted yield relative to volatility

- Determine optimal lock-up periods for staking

APR also informs decisions around capital allocation between passive staking and active yield farming. In high-risk environments, stable APRs may be preferable to volatile APYs with compounding risk.

APR in Lending vs. Staking: Comparative Analysis

APR in lending protocols reflects borrower demand and collateral efficiency. In staking, APR is tied to network inflation, validator performance, and slashing risk. Key distinctions include:

- Lending APR: Market-driven, responsive to borrower activity

- Staking APR: Protocol-defined, subject to governance and network health

Understanding these differences is critical for building resilient yield strategies, especially in volatile macro conditions.

APR Trends in 2025–2026: What to Expect

Based on current data and protocol roadmaps, the following APR trends are anticipated:

- Declining APRs in major staking networks due to reduced inflation schedules

- Increased APR volatility in lending platforms tied to stablecoin demand

- Emergence of dynamic APR models using real-time governance inputs

- Greater APR transparency driven by regulatory pressure and institutional onboarding

Protocols such as EigenLayer and Lido are already experimenting with modular APR structures, allowing users to select risk tiers and corresponding yield rates.

Key Questions for APR Evaluation

Before committing capital based on APR, professionals should ask:

- Is the APR sustainable or subsidized?

- What is the source of yield — fees, inflation, or emissions?

- How frequently is APR updated or recalculated?

- Is APR net of fees, slashing, or impermanent loss?

- Does APR reflect real-time market conditions or static assumptions?

These questions help filter marketing-driven APR claims from actual yield potential, reducing exposure to unsustainable protocols.

Advanced APR Modeling in Crypto: Beyond Surface-Level Yield

APR in cryptocurrency is not a static figure. For professional investors, understanding its dynamic behavior requires modeling across multiple dimensions: protocol mechanics, tokenomics, liquidity depth, and macroeconomic overlays. Below are key modeling approaches used in institutional-grade analysis.

1. Protocol-Level APR Simulation

APR can be projected using smart contract parameters and historical reward distributions. For example, staking APR on Ethereum can be modeled based on:

- Total staked ETH vs circulating supply

- Validator performance and uptime

- Slashing penalties and network inflation rate

Protocols like Lido and Rocket Pool publish real-time APR dashboards, but institutional models often include stress testing under network congestion or validator churn scenarios.

2. Token Emission-Based APR

In yield farming and liquidity mining, APR is often derived from token emissions. This model includes:

- Emission schedule (linear, halving, decay)

- Token price volatility and liquidity

- Protocol treasury sustainability

High APRs driven by aggressive emissions are typically unsustainable. Analysts apply discounted cash flow (DCF) models to estimate real yield after token dilution.

3. Risk-Adjusted APR (rAPR)

Raw APR figures do not account for risk. rAPR incorporates:

- Smart contract audit status

- Protocol age and exploit history

- Liquidity lock-up duration

- Market volatility and impermanent loss exposure

For example, a 20% APR on a newly launched DEX with unaudited contracts may carry a risk-adjusted yield closer to 5–7%. Institutional dashboards often include rAPR overlays to guide capital allocation.

4. APR Forecasting Under Macroeconomic Conditions

APR in crypto is increasingly sensitive to macroeconomic variables:

- Federal Reserve policy: Rate cuts increase risk-on appetite, boosting DeFi borrowing and APRs.

- Stablecoin demand: Higher demand for USDC/DAI lending raises APRs on platforms like Aave.

- Geopolitical risk: Capital flight into crypto can temporarily inflate APRs due to liquidity imbalances.

Professional investors use macro overlays to forecast APR behavior during monetary easing, inflation spikes, or regulatory shifts.

Institutional Perspectives on APR: Allocation, Governance, and Compliance

As institutional capital enters crypto, APR is no longer viewed as a retail yield metric. It is now a governance tool, a compliance signal, and a portfolio optimizer.

APR as a Governance Lever

Protocols increasingly use APR to incentivize desired behaviors:

- Higher APR for long-term staking to reduce token velocity

- Dynamic APR for liquidity pools to balance asset ratios

- APR boosts for governance participation or protocol upgrades

These mechanisms are encoded in smart contracts and governed via on-chain voting. Institutional delegates often propose APR adjustments to align incentives with protocol sustainability.

APR and Regulatory Compliance

APR disclosures are under scrutiny from regulators. In the U.S., the SEC and CFTC have raised concerns about misleading yield claims. Key compliance practices include:

- Clear separation of base APR and promotional APR

- Real-time updates and historical APR logs

- Risk disclosures tied to APR volatility

Protocols targeting institutional adoption increasingly publish audited APR methodologies and integrate compliance dashboards for reporting purposes.

APR in Multi-Chain Portfolio Optimization

Cross-chain yield strategies require APR normalization across ecosystems. For example:

- Comparing APR on Solana staking vs Ethereum validators

- Evaluating APR on Avalanche lending vs Arbitrum liquidity pools

Professional tools like DeBank, Zerion, and custom Dune dashboards allow APR aggregation and filtering by risk, duration, and asset type. This enables dynamic rebalancing based on yield efficiency.

APR Decline Scenarios: What Happens When Yield Compresses?

APR compression is a natural outcome of protocol maturity and market saturation. Key triggers include:

- Reduced token emissions due to governance votes

- Increased staking participation diluting rewards

- Stablecoin lending oversupply reducing borrower demand

Professionals respond by rotating capital into emerging protocols, adjusting lock-up durations, or shifting toward APY-based compounding strategies. Yield compression also accelerates innovation in modular staking and real-world asset (RWA) integrations.

Strategic Recommendations for APR-Based Yield Management

Based on current trends and institutional behavior, the following strategies are recommended:

- Prioritize protocols with audited APR methodologies and transparent reward sources

- Use rAPR models to assess true yield after risk adjustment

- Monitor governance proposals affecting APR structures

- Integrate macroeconomic overlays into APR forecasting models

- Diversify across staking, lending, and liquidity pools to balance APR exposure

APR is no longer a static metric — it is a dynamic signal reflecting protocol health, market demand, and strategic intent. Professionals who understand its mechanics gain a significant edge in portfolio construction and risk management.

APR in Crypto: Professional FAQ for Yield Strategy Optimization

What is APR in cryptocurrency?

APR (Annual Percentage Rate) in crypto refers to the annualized return on assets without compounding. It is commonly used in staking, lending, and liquidity provision protocols to measure yield.

How does APR differ from APY in DeFi?

APR excludes compounding, while APY includes it. APY is typically used in auto-compounding vaults, whereas APR is preferred for fixed-rate staking and lending models.

What affects APR in crypto lending platforms?

APR is influenced by borrower demand, collateral efficiency, liquidity pool depth, and protocol governance. Market volatility and stablecoin utilization also play key roles.

Is high APR in yield farming sustainable?

Not always. High APRs often result from aggressive token emissions, which may lead to dilution and unsustainable reward structures. Risk-adjusted APR (rAPR) should be used for accurate yield assessment.

How do staking APRs change over time?

Staking APRs fluctuate based on network inflation, validator performance, and total staked supply. Governance decisions and slashing events can also impact APR levels.

Can APR be used to compare crypto protocols?

Yes, but with caution. APR should be normalized across protocols by adjusting for risk, lock-up duration, and reward source. Institutional dashboards often include APR filters for strategic comparison.

What is a good APR for crypto staking in 2025?

Typical APRs range from 4% to 12% for major networks like Ethereum, Solana, and Avalanche. Higher APRs may be available in emerging protocols, but carry increased risk.

How do institutions evaluate APR in crypto markets?

Institutions use APR as a yield signal, governance tool, and compliance metric. They apply modeling techniques, macroeconomic overlays, and risk-adjusted frameworks to guide capital allocation.

What is promotional APR in crypto?

Promotional APR includes temporary boosts or token incentives offered by protocols to attract liquidity. These rates are often unsustainable and should be evaluated separately from base APR.

How does APR impact crypto portfolio construction?

APR informs decisions around staking vs lending, lock-up durations, and cross-chain yield strategies. It helps optimize risk-adjusted returns and liquidity management.

What are the risks of relying on APR alone?

APR does not account for smart contract risk, impermanent loss, slashing, or token volatility. It should be used in conjunction with rAPR and APY metrics for comprehensive yield analysis.

How frequently is APR updated in DeFi protocols?

APR updates vary by protocol. Some platforms offer real-time recalculations, while others update daily or weekly. Institutional-grade platforms provide historical APR logs for transparency.

Can APR be manipulated by protocols?

Yes. APR can be adjusted via governance votes, token emissions, or reward algorithms. Investors should monitor protocol governance and audit APR methodologies before committing capital.

Is APR relevant for real-world asset (RWA) integrations?

Absolutely. APR is used to benchmark yield in tokenized treasury bills, real estate, and invoice financing. It bridges traditional finance and DeFi through standardized yield metrics.

What tools help track APR across chains?

Platforms like DeBank, Zerion, Dune Analytics, and custom institutional dashboards allow APR aggregation, filtering, and historical analysis across Ethereum, Solana, Arbitrum, and more.

How will APR evolve in 2026?

APR will become more modular, dynamic, and governance-driven. Expect increased transparency, regulatory alignment, and integration with real-world yield sources. Institutional adoption will standardize APR disclosures.

Disclaimer

This article is intended for informational and educational purposes only. It does not constitute financial advice, investment recommendations, or legal counsel. Cryptocurrency markets are volatile and subject to regulatory uncertainty. Yield metrics such as APR and APY may fluctuate and carry inherent risks. Always conduct independent due diligence and consult with licensed professionals before making financial decisions.