CEX vs. Wallet: Secure Your Crypto 401k Storage Strategy

The Great Custody Debate: Exchange vs. Wallet, Why Your Keys are the Only True 401k of Crypto

In the wake of high-profile exchange failures, most notably the collapse of FTX, the question of crypto custody has become a defining issue for retail investors. Billions in customer funds were frozen or lost, not because of market volatility, but due to a failure in custodial trust. This is not a theoretical risk—it’s a real and recurring threat.

At its core, crypto custody defines who controls your assets. There are two primary models:

- Custodial Storage — where a centralized exchange (CEX) holds your private keys.

- Self-Custody — where you, the user, retain full control via a wallet.

Security analysts and our team recommend a sober evaluation of both models. The principle is simple but uncompromising: “Not your keys, not your coins.” If you don’t control your private keys, you don’t control your crypto.

| CEX Custody | Self-Custody |

|---|---|

| User → Exchange → Crypto Private key held by Exchange |

User → Wallet → Crypto Private key held by User |

This article provides a comprehensive, security-first guide to help you define your personal custody strategy. Whether you’re holding $500 or $50,000, understanding the trade-offs between convenience and control is essential.

The Convenience Trap: When Exchanges Go Bust

Centralized Exchanges (CEXs) offer unmatched convenience. They provide liquidity, fiat on/off-ramps, and simplified tax reporting. For many beginners, they are the default entry point into crypto. But this convenience comes at a cost.

Counterparty risk is real. When you store crypto on a CEX, you are trusting a third party to safeguard your assets. If that party fails—due to insolvency, fraud, or regulatory seizure—your funds may be frozen or lost. The FTX collapse is the definitive example: billions in customer assets vanished overnight, with little recourse for recovery.

Other risks include:

- Frozen assets during market volatility or legal investigations.

- No access to DeFi or NFTs—CEXs restrict wallet connectivity.

- Single point of failure—if the exchange is compromised, so are your funds.

True Sovereignty: The Power and Peril of Self-Custody

Self-custody means full control. You hold your private keys, manage your wallet, and interact directly with decentralized protocols. This model offers true ownership and censorship resistance.

Benefits include:

- Full access to DeFi and NFTs via wallet connectivity. See our guide to wallets that support low-risk DeFi strategies.

- Censorship resistance—no third party can freeze or block your assets.

- Complete sovereignty over your funds and transactions.

But with great power comes great responsibility. Risks include:

- User error—a lost seed phrase means irreversible loss.

- High setup complexity—wallets require technical understanding.

- No support—you are your own bank, with no customer service.

| Parameter | Centralized Exchange (CEX) | Self-Custody Wallet |

|---|---|---|

| Key Control | Exchange retains all private keys. | User retains all private keys. |

| Primary Risk | Institutional Failure (Insolvency, FTX) | User Error (Loss of Seed Phrase) |

| DeFi/NFT Access | None/Restricted | Full Access (Mandatory) |

| Learning Curve | Low (Beginner-friendly) | Medium to High (Security responsibility) |

Beyond Hot and Cold: Choosing Your Storage Strategy

Hot Wallets (Software/Mobile)

Hot wallets are connected to the internet and designed for daily use. They are ideal for small amounts and active trading. Examples include mobile apps like Trust Wallet or browser extensions like MetaMask. While convenient, they are more vulnerable to phishing and malware.

Cold Wallets (Hardware/Paper)

Cold wallets are offline and air-gapped, offering maximum security. These include hardware devices like Ledger or Trezor, and even paper wallets stored in secure locations. They are best suited for long-term holdings and retirement funds. Without internet access, they are immune to remote attacks.

The Future: Smart Wallets and Account Abstraction (AA)

Next-generation wallets are emerging with features like social recovery, programmable permissions, and account abstraction. These innovations aim to reduce the risk of seed phrase loss while maintaining user control. While still early-stage, they represent a promising evolution in custody technology.

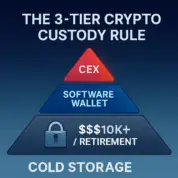

The 2026 Consensus: Defining Your Personal Custody Strategy

There is no one-size-fits-all solution. Your custody strategy should reflect your portfolio size, risk tolerance, and technical comfort. For most users, a hybrid approach works best: cold storage for savings and retirement, hot wallets for active use.

| Portfolio Level | Recommended Storage Type | Primary Goal |

|---|---|---|

| Active Trading / Small Amount (<$500 USD) | Hot Wallet (Mobile/Software) or CEX Trading Account | Liquidity and Speed |

| Mid-Tier Holding ($500 – $10,000 USD) | Dedicated Software Wallet (e.g., MetaMask with strong 2FA) | Balance of Security and Usability |

| Long-Term / Retirement ($10k+ USD) | Hardware Wallet (Cold Storage) | Maximum Security and Sovereignty |

Mandatory Security Action

Regardless of your custody choice, always enable Two-Factor Authentication (2FA) on all crypto-related accounts. Store your seed phrase offline, in a secure and fireproof location. Never share it digitally or with third parties.

Don’t Let the FTX Lesson Be Forgotten

Crypto custody isn’t just a technical choice—it’s a personal responsibility. The collapse of FTX was a wake-up call for millions, and it won’t be the last. Whether you’re just starting out or planning your crypto retirement, the decisions you make today will define your financial sovereignty tomorrow.

We urge you to take custody seriously. Learn, prepare, and protect your assets. The tools are available. The risks are real. And the control is yours to claim.

Stay informed. Stay secure. Subscribe for more security insights and market analysis—because your keys are more than just access. They’re your future.

DISCLAIMER

This article is for informational and educational purposes only and does not constitute financial, tax, or investment advice. Always conduct your own research (DYOR) and consult a qualified professional before making investment decisions. The decision to use self-custody or an exchange involves unique risks, and only you are responsible for the security of your funds.