Bitcoin Drops to $95K: Why BTC Fell, Market Analysis & Future Outlook 2025

Bitcoin Drops to $95,000: Reasons, Market Factors, and the Future of BTC

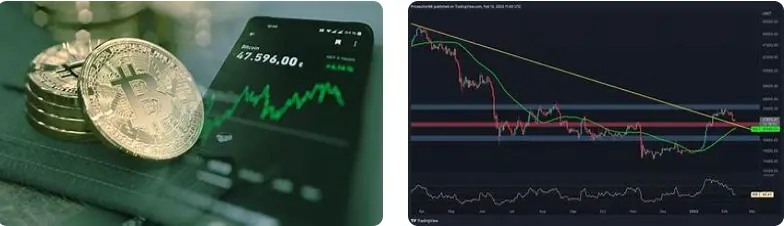

On February 10, 2025, Bitcoin (BTC) experienced a dip to $95,000, catching the eyes of crypto enthusiasts and investors across the globe. This movement sparked questions about what’s driving the decline and what it means for the future of Bitcoin.

So, what happened? Why did BTC fall to this level, and what can traders and HODLers expect next?

Key Reasons Behind Bitcoin’s Drop

- Global economic instability.

Recent turbulence in global financial markets has impacted Bitcoin’s price. Rising trade tensions and uncertain macroeconomic indicators push investors toward safer assets, affecting crypto markets. Bitcoin feels the ripple effects, along with other top coins. - US interest rate hikes.

When the Federal Reserve increases interest rates, the US dollar strengthens. That makes riskier assets like Bitcoin less attractive. Investors often pull capital from crypto, seeking more predictable returns in traditional financial instruments. - Shift from crypto investments to traditional assets.

Uncertainty in crypto regulation and market volatility encourages some investors to move funds into government bonds or blue-chip stocks. This short-term exodus contributes to downward pressure on BTC. - Exchange-specific challenges.

Regulatory pressure on major platforms like Binance and Kraken adds uncertainty. Compliance requirements in the US, UK, and EU make investors cautious, reducing trading volume and demand for Bitcoin.

Impact on the Broader Crypto Market

Bitcoin’s dip to $95,000 isn’t happening in isolation. The broader crypto market, including Ethereum (ETH), Ripple (XRP), and other altcoins, also experienced a significant drop. When Bitcoin wobbles, the rest of the market feels it—classic BTC dominance effect. ➡️

Still, crypto veterans know this game well: Bitcoin has always been volatile. Such dips are often temporary, and historically, BTC rebounds, sometimes stronger than before. So yes, panic is natural—but don’t FOMO into rash decisions.

Future Outlook for Bitcoin

Despite short-term dips, many analysts remain bullish on Bitcoin’s long-term potential. Key factors supporting future growth include:

- Institutional adoption.

Banks, hedge funds, and large investment firms are increasingly adding Bitcoin to their portfolios. Institutional capital can drive BTC prices up and increase market legitimacy. - Blockchain and Lightning Network innovations.

Technology improvements are making Bitcoin faster, cheaper, and more scalable. Enhanced payment solutions could boost adoption for everyday transactions. - Regulatory clarity.

Clearer legal frameworks in the US, UK, Canada, and Australia could attract more investors. Transparent regulations reduce uncertainty, making crypto a more mainstream investment tool. - Volatility as opportunity.

Market swings aren’t just scary—they’re profitable. Traders can capitalize on dips and rallies if they stay informed and patient. Remember: high risk, high reward!

Investor Takeaways

If you’re treating Bitcoin as a long-term investment, understand that volatility is part of the ride. Monitor economic and political events that could influence BTC, and adjust your strategy accordingly. For traders, short-term swings can be opportunities—but only with a cool head and solid research.

Even after this recent drop to $95,000, Bitcoin’s long-term prospects remain strong. The market continues to mature, adoption grows, and BTC’s role in global finance is far from over.

Looking Ahead with Optimism

Current BTC price: $96,202. The market is dynamic, and opportunities abound for those ready to HODL or trade wisely.

Long-Term Price Forecasts

Experts suggest that Bitcoin could potentially reach $200,000 in 2025 if adoption and institutional investments continue to grow. However, high volatility and macroeconomic factors mean caution is key.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is shaped by global economic trends, regulatory shifts, technological advancements, and adoption levels across markets. US interest rates, market sentiment, and crypto regulations are especially influential.

Risks and Uncertainties

Crypto investments come with risks. Volatility, regulatory ambiguity, and external economic shocks can all impact BTC. Careful research and risk management are essential.

Conclusion

Bitcoin remains a high-potential but volatile asset. Investors should monitor market developments, stay informed, and approach trading strategically. Remember: in crypto, patience, knowledge, and hype-control are your best friends.

Disclaimer / No Liability

We are not financial advisors and assume no responsibility for any decisions you make.

Cryptocurrencies are highly volatile and risky. You may lose all invested capital.

Always do your own research (DYOR) and consult qualified professionals before making any financial or legal decisions.

We make no guarantees regarding the accuracy, completeness, or reliability of the information provided.

References to third-party services or projects do not imply endorsement.

By using this site, you agree that all actions are at your own risk and you release the site owners and authors from any liability.