Safeguard your crypto assets with this expert guide

The Essential Guide to Crypto Scam Avoidance and Wallet Security

Defining the Threat Landscape: Types of Crypto Fraud

Investment Scams (The “Get Rich Quick” Trap)

Crypto investment scams often masquerade as legitimate opportunities, promising outsized returns with minimal risk. These schemes typically exploit FOMO (fear of missing out), targeting users with flashy websites, fake testimonials, and aggressive marketing. The hallmark of such scams is urgency—limited-time offers, countdown timers, and pressure to act fast. Once funds are transferred, victims discover that the project was either non-existent or designed to collapse.

A prime example is the Terra/LUNA collapse in 2022. While not a traditional scam, it illustrates how algorithmic risk and flawed economic mechanisms can devastate investors. Terra’s UST stablecoin was marketed as a safe yield-bearing asset, but its peg relied on circular logic and unsustainable incentives. When market confidence eroded, the system unraveled, wiping out billions in investor capital. The lesson: even well-branded projects can implode if their fundamentals are weak.

Warning Signs in DeFi: How to Spot a Rug Pull Before It Happens

Rug pulls are a form of exit scam where developers abandon a project after draining liquidity. These are especially common in decentralized finance (DeFi), where anonymous teams can launch tokens with minimal oversight. To avoid falling victim, users must scrutinize smart contract audits, token liquidity, and developer transparency.

- Audit Status: Legitimate projects undergo third-party code audits. Absence of audits or reliance on unverifiable “self-audits” is a red flag.

- Liquidity Lock: Check whether liquidity is locked in a smart contract. If developers retain control, they can withdraw funds at any time.

- Team Identity: Anonymous or pseudonymous teams increase risk. Look for doxxed founders with verifiable credentials.

In the case of the Ronin Bridge hack (Axie Infinity, 2022), attackers exploited a centralized validator setup with weak multi-signature protections. Although not a rug pull, it underscores the danger of poor key management and the illusion of decentralization.

Recognizing Pyramid Schemes and Ponzi Scams in Web3

Web3 has seen a resurgence of classic Ponzi and pyramid schemes, repackaged with crypto jargon. These scams promise passive income through referral bonuses, staking rewards, or “yield farms” that rely on continuous user onboarding. The returns are often unsustainable and collapse once new deposits slow down.

Key indicators include:

- Guaranteed Returns: No legitimate crypto project can guarantee profits. Promises of fixed yields are a major warning sign.

- Referral-Driven Growth: If the business model depends heavily on recruiting others, it’s likely a pyramid scheme.

- Lack of Product Utility: Scams often lack a real product or service, focusing solely on tokenomics and hype.

Due diligence is essential. Always ask: What value does this project create beyond speculative gains?

Social Engineering and Phishing Attacks

Defending Against Phishing and Fake Exchange Websites

Phishing remains one of the most effective attack vectors in crypto. Scammers create fake exchange websites, wallet interfaces, or impersonate support staff to trick users into revealing private keys or seed phrases. These sites often mimic legitimate platforms with pixel-perfect design and domain spoofing.

To defend against phishing:

- Verify URLs: Always double-check the domain. Use bookmarks for trusted platforms and avoid clicking links from unsolicited messages.

- Look for HTTPS: Secure sites use HTTPS with valid certificates. Absence of encryption is a red flag.

- Use Browser Extensions: Tools like MetaMask flag known phishing domains and can prevent accidental visits.

The 2020 Twitter hack exemplifies the power of social engineering. Attackers gained access to internal tools and tweeted from verified accounts, promoting a Bitcoin giveaway. Thousands of users sent funds, trusting the legitimacy of blue checkmarks. The takeaway: never trust unsolicited crypto addresses, even from verified profiles.

The Dangers of “Pig Butchering” Scams and Romance Fraud

“Pig butchering” is a long-con scam where victims are emotionally manipulated over weeks or months. Scammers pose as romantic interests or business mentors, gradually introducing crypto investments. The victim is led to believe they’re part of a lucrative opportunity, often using fake dashboards and staged profits.

Psychological manipulation is the core weapon. Victims are isolated, flattered, and pressured to invest more. Once the scammer has extracted maximum funds, they vanish—leaving emotional and financial devastation.

To protect yourself:

- Be Skeptical of Sudden Investment Advice: Especially from new online acquaintances.

- Never Share Wallet Access: No legitimate partner or advisor needs your seed phrase or private key.

- Report Suspicious Behavior: Platforms like Chainabuse allow users to flag scams and warn others.

Technical Exploits and Malicious Software

Avoiding Wallet Drainers and Signature Phishing

Wallet drainers are malicious scripts embedded in fake DApps or phishing sites. They exploit wallet permissions—especially the “Approve” function—to siphon tokens without explicit transfers. Signature phishing tricks users into signing transactions that grant unlimited access to assets.

Best practices include:

- Review Permissions: Use tools like Revoke.cash to audit and revoke unnecessary approvals.

- Understand What You Sign: Never sign blind transactions. Read the prompts carefully and verify the source.

- Update Wallet Software: Ensure your wallet is running the latest firmware to patch known vulnerabilities.

Zero-day exploits—unknown vulnerabilities—can bypass even cautious setups. That’s why layered security and proactive monitoring are essential.

Operational Security: Protecting Your Wallet and Digital Assets

Key Management and Storage Best Practices

Cold vs. Hot Storage: A Guide to Hardware Wallet Security and Firmware Verification

Effective crypto security begins with understanding the difference between cold and hot storage. Hot wallets—connected to the internet—offer convenience but are vulnerable to malware, phishing, and browser-based exploits. Cold wallets, such as hardware devices, store private keys offline, significantly reducing attack surfaces.

When selecting a hardware wallet, prioritize devices with open-source firmware and a history of independent audits. Closed-source wallets may hide vulnerabilities, while open-source models allow community scrutiny. Always verify firmware authenticity before installation—download only from official sources and cross-check cryptographic hashes.

Key practices include:

- Use a Dedicated Device: Never install wallet software on shared or compromised machines.

- Enable PIN and Passphrase Protection: Most hardware wallets support layered access controls—use them.

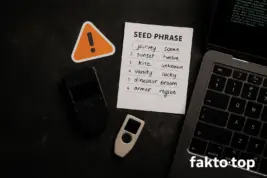

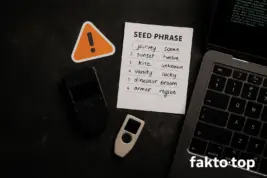

- Backup Seed Phrases Securely: Store backups offline in tamper-evident containers. Avoid cloud storage or digital notes.

Remember: physical security matters. A stolen hardware wallet with an exposed seed phrase is no safer than a compromised hot wallet.

Advanced Wallet Security: Utilizing Multi-Sig and Time Locks

Multi-signature (multi-sig) wallets require multiple private keys to authorize transactions. This setup is ideal for teams, DAOs, or high-value accounts, reducing the risk of unilateral fund movement. Time locks add another layer, delaying transactions until a preset period elapses—useful for preventing impulsive or unauthorized transfers.

Popular multi-sig platforms include Gnosis Safe and Sparrow Wallet. When configuring multi-sig:

- Distribute Keys Across Devices: Avoid storing all keys on the same machine or with the same person.

- Use Redundant Signers: Include backup signers in case of device failure or loss.

- Audit Transaction Logs: Regularly review activity to detect anomalies or unauthorized attempts.

Time locks can be implemented via smart contracts or wallet settings. They’re especially useful for treasury management, where oversight and delay are strategic safeguards.

The Final Defense: Due Diligence and Verification Protocol

Verification Protocol: The Essential Due Diligence Checklist

Before investing in any crypto project, users must perform rigorous due diligence. The decentralized nature of Web3 means there’s no central authority vetting legitimacy—responsibility falls entirely on the user. Here’s a structured checklist to guide your evaluation:

- Team Identity: Are the founders doxxed? Look for LinkedIn profiles, past projects, and public interviews. Anonymous teams increase risk.

- Code Audit Status: Has the smart contract been audited by a reputable firm (e.g., CertiK, Trail of Bits)? Read the audit report—don’t rely on badges alone.

- Tokenomics: Analyze supply distribution, vesting schedules, and inflation mechanisms. Beware of projects with disproportionate insider allocations.

- Community Sentiment: Join Discord, Telegram, or Reddit channels. Gauge user engagement, transparency, and responsiveness. Echo chambers or overly moderated groups may signal manipulation.

- Liquidity Analysis: Is the token listed on reputable exchanges? Check for locked liquidity and trading volume consistency. Thin liquidity can lead to price manipulation or exit scams.

- Roadmap and GitHub Activity: Review development milestones and code commits. Stagnant or inactive repositories suggest abandonment.

Due diligence is not optional—it’s your final defense. Treat every project as a potential risk until proven otherwise. If any element of the checklist raises concern, walk away. No opportunity is worth compromising your financial safety.

Expanded FAQ: The Trust Section

Critical Questions and Immediate Action Protocol

What Should I Do Immediately If I Suspect My Wallet Has Been Compromised?

If you believe your wallet has been compromised, act swiftly. First, disconnect it from all DApps and browser extensions. This prevents further unauthorized interactions. Next, transfer any remaining funds to a secure wallet—preferably a hardware wallet with fresh seed phrases. Avoid reusing compromised keys or devices.

Then, audit your wallet permissions using tools like Revoke.cash or Etherscan’s token approval checker. Revoke any suspicious or unnecessary approvals. Finally, report the incident to relevant platforms (e.g., exchanges, wallet providers) and consider filing a complaint with local cybercrime authorities. Time is critical—every minute counts.

How Can I Verify the Authenticity of a Cryptocurrency Project or DApp?

Start by checking whether the project has undergone a third-party code audit. Reputable firms like CertiK or OpenZeppelin publish detailed reports—read them, don’t just trust badges. Next, examine the team’s identity. Are the founders doxxed? Do they have a history of credible work in the space?

Review token liquidity: Is it locked? Is the trading volume consistent? Thin or unlocked liquidity is a red flag. Finally, assess community sentiment. Join Discord or Telegram channels and observe how the team engages. Transparency, responsiveness, and technical depth are signs of legitimacy.

Can I Recover Funds Lost to a “Rug Pull” or Phishing Attack?

Recovery is difficult and often unlikely. In rug pulls, developers vanish with liquidity, leaving no legal recourse. In phishing attacks, stolen funds are quickly laundered across chains. However, you can report the incident to platforms like Chainabuse or ScamSniffer, which may help trace transactions.

Law enforcement may assist if the scam involves large sums or identifiable actors. Blockchain forensics firms like Chainalysis can sometimes aid investigations. But be realistic—most losses are irreversible. Prevention is your best defense.

What is the Difference Between an Exchange Hack and a Wallet Exploit?

An exchange hack targets centralized platforms, often compromising user databases, hot wallets, or internal systems. Recovery may be possible if the exchange has insurance or reserves. A wallet exploit, however, affects individual users—typically through phishing, malware, or poor key management.

In wallet exploits, the user bears full responsibility. Funds are usually unrecoverable unless the attacker makes a mistake. The key distinction is control: centralized entities may offer restitution; decentralized wallets do not.

Is Using a VPN or Tor Enough to Protect My Privacy and Security?

VPNs and Tor enhance network privacy by masking IP addresses and encrypting traffic. However, they do not protect your private keys, wallet permissions, or device integrity. Many attacks occur locally—through malware, clipboard hijacking, or malicious browser extensions.

Use VPNs as part of a layered security strategy, not a standalone solution. Combine them with hardware wallets, permission audits, and secure devices. Privacy ≠ security. Both require distinct, proactive measures.

What is the Role of KYC/AML Compliance in Protecting Investors?

Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are legal frameworks that help prevent fraud, terrorism financing, and illicit activity. Exchanges that enforce KYC/AML are more likely to cooperate with law enforcement and offer user protections.

While some users prefer anonymity, engaging with unregistered platforms increases risk. If a platform lacks basic compliance, it may also lack accountability. Always verify whether an exchange is licensed in your jurisdiction and complies with relevant financial regulations.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency involves significant risk, and readers are strongly encouraged to consult licensed financial or tax professionals before making any decisions. fakto.top assumes no liability for losses incurred from actions taken based on this content.