Bitcoin Mining in 2025: Difficulty Hits ATH Amid Infrastructure Shif

Bitcoin Mining Hits Peak Difficulty: What It Means for 2025–2027

In September 2025, Bitcoin mining just flexed harder than ever. The network’s difficulty reached a new all-time high, making it tougher, costlier, and more centralized than most retail miners ever imagined. But this isn’t just about numbers — it’s about power, access, and the future of decentralized mining. Let’s break it down: what changed, who’s winning, and what’s next.

Then vs Now: Mining Difficulty Evolution

| Year | Difficulty Level | Dominant Miner Type | Energy Strategy | Retail Viability |

|---|---|---|---|---|

| 2013 | ~1M | Home rigs, early ASICs | Standard grid | High — garage setups thrived |

| 2017 | ~1B | ASIC farms | Cheap electricity zones | Medium — entry cost rising |

| 2021 | ~25T | Industrial farms + pools | Hydro, solar, off-grid | Low — competition intense |

| 2025 | 142.3T (ATH) | Institutional miners, energy giants | Dynamic load balancing, surplus energy | Minimal — solo mining nearly extinct |

Bitcoin mining difficulty is now a gatekeeper. It filters out hobbyists and rewards those with deep infrastructure, energy arbitrage, and access to custom firmware. The hash wars of 2025 aren’t just about who mines more — they’re about who controls the future of block rewards and network security.

⚡ September 2025 Snapshot: Who’s Mining and How

| Region | Hashrate Share | Energy Source | Dominant Players | Trend |

|---|---|---|---|---|

| Texas, USA | ~18% | Grid + renewables | ERCOT-integrated miners | Expanding |

| Pakistan | ~6% | Surplus hydro | State-backed pilot farms | Emerging |

| BUTAN | ~4% | Hydro | Government + Bitdeer | Stable |

| Latin America | ~9% | Geothermal, solar | Private + sovereign miners | Fragmented |

| Retail (Global) | <1% | Grid | Small pools, cloud mining | Declining |

Mining centralization risks are real. While Bitcoin remains decentralized in protocol, its production layer is increasingly dominated by energy-backed institutions. The economics of mining in 2025 favor scale, not ideology.

Looking Ahead: 2026–2027 Expectations

✅ What We Expect

- More energy-integrated mining: Smart grids, dynamic pricing, and tokenized energy credits

- ASIC saturation: Next-gen chips with AI optimization and firmware-level governance

- Mining pools consolidation: Top 5 pools may control 80%+ of hashrate

- Regulatory clarity: U.S. and EU frameworks for energy-backed crypto operations

What We Hope For

- Retail mining revival: Through cooperative models, decentralized pools, or L2 incentives

- Green mining incentives: Carbon-neutral rewards, ESG scoring baked into block validation

- Open-source firmware: To level the playing field across ASIC generations

What We Don’t Believe In

- “Decentralization by default”: Without structural reform, mining will stay centralized

- Solo mining comeback: Unless block rewards spike massively, it’s economically unviable

- Zero-regulation utopia: Energy consumption will force policy intervention

Bitcoin mining in 2025 is no longer a DIY hustle — it’s a geopolitical, infrastructural, and economic game. But the story isn’t over. The next chapters will be written by those who adapt, innovate, and rethink what decentralization really means.

Mining Economics in 2025: The Game Has Changed

Forget the garage rigs and DIY setups — Bitcoin mining in 2025 is a full-blown industrial sport. The economics have shifted dramatically. Block rewards are still 6.25 BTC, but the cost to compete has exploded. Between ASIC saturation, energy arbitrage, and firmware-level optimization, only the most efficient survive.

Cost vs Reward: Mining ROI Breakdown

| Setup Type | Initial Cost | Monthly Energy Cost | Expected ROI (12 mo) | Risk Level |

|---|---|---|---|---|

| Home ASIC (1 unit) | $2,000 | $180 | Negative | High |

| Small Farm (10 units) | $20,000 | $1,600 | Break-even (if subsidized) | Medium |

| Institutional Farm (1000+ units) | $2M+ | $120,000+ | Profitable (with energy arbitrage) | Low |

Solo mining is nearly extinct. Mining pool centralization is accelerating, with top pools controlling over 70% of the global hashrate. ASIC optimization — including undervolting, firmware tweaks, and thermal balancing — is now standard. If you’re not running custom firmware, you’re burning money.

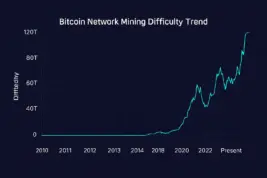

Bitcoin Network Mining Difficulty Trend

The chart above shows how mining difficulty has evolved — and exploded — over the last decade. The spike in 2025 isn’t just technical. It reflects a shift in who controls the network’s backbone. The hash wars are real, and they’re being fought by energy giants, not cypherpunks.

2026–2027: What’s Next for Bitcoin Mining?

What We Expect

- Energy-backed mining tokens: Projects linking hashpower to tokenized energy credits

- AI-optimized ASICs: Chips that self-adjust for efficiency and network conditions

- Mining pool DAOs: Governance models for decentralized pool management

- Smart grid integration: Miners acting as dynamic energy consumers in real-time markets

What We Hope For

- Retail access revival: Through cooperative mining, shared infrastructure, or L2 incentives

- Carbon-neutral mining: ESG scoring baked into block validation and pool reputation

- Open firmware standards: To democratize ASIC performance and reduce vendor lock-in

What We Don’t Believe In

- Solo mining comeback: Unless block rewards spike or difficulty drops, it’s dead

- Zero-regulation future: Energy consumption will force policy, especially in the U.S.

- “Decentralization by default”: Without structural reform, mining will stay centralized

Bitcoin mining is evolving — fast. The next two years will define whether it remains a decentralized backbone or becomes an energy-backed oligopoly. The tech is impressive. The risks are real. The opportunity? Still massive — if you know where to look.

Infrastructure Wars: Mining Is Now a Hardware Arms Race

In 2025, mining isn’t just about plugging in an ASIC — it’s about building a fortress. The top players are deploying immersion-cooled containers, firmware-optimized rigs, and real-time energy arbitrage systems. This isn’t crypto — it’s crypto-industrial.

ASIC Firmware Wars

- Custom firmware: Boosts efficiency, undervolts chips, and bypasses vendor limits

- Closed ecosystems: Major manufacturers locking users into proprietary updates

- Open-source push: Community devs fighting back with decentralized firmware forks

Firmware is the new battleground. Whoever controls the chip logic controls the margins. And in mining, margins are survival.

Mining Infrastructure: Who’s Building What

- Texas: Modular farms with smart grid integration and real-time load balancing

- Pakistan: State-backed hydro farms using surplus energy from legacy dams

- Latin America: Hybrid setups mixing geothermal, solar, and community pools

- Europe: ESG-compliant mining zones with carbon scoring and policy incentives

The infrastructure gap is widening. Retail miners can’t compete with containerized farms running 24/7 on subsidized energy. The crypto market may be decentralized — but its production layer is increasingly monopolized.

Culture Shift: From Cypherpunks to Crypto Engineers

Back in 2013, mining was rebellious. It was about sticking it to the banks, running rigs in basements, and tweeting block rewards like trophies. In 2025, it’s about uptime, firmware patches, and energy contracts. The vibe has changed.

Then vs Now: Mining Culture Comparison

| Era | Mindset | Tools | Community | Symbolism |

|---|---|---|---|---|

| 2013–2017 | Cypherpunk, DIY, anti-bank | GPU rigs, early ASICs | Forums, IRC, Reddit | “I mine, therefore I rebel” |

| 2021 | Speculative, meme-driven | ASIC farms, cloud mining | Twitter, Telegram, TikTok | “Pump it, mine it, flex it” |

| 2025 | Industrial, strategic, energy-aware | Immersion rigs, firmware stacks | GitHub, DAO forums, energy councils | “Hashrate is infrastructure” |

Mining isn’t dead — it’s evolved. The question is whether the culture can keep up. Can decentralization survive industrialization? Can community-driven mining models compete with energy-backed giants? Can firmware become open again?

Hashrate Governance: Who Owns the Backbone?

As mining pools consolidate, governance becomes critical. Who decides which blocks get validated? Who sets pool policies? Who controls the firmware updates? These aren’t technical questions — they’re political.

️ Pool Governance Models Emerging

- DAO-based pools: Token holders vote on block inclusion, fees, and upgrades

- Private pools: Closed governance, high efficiency, zero transparency

- Hybrid models: Combining token voting with validator councils

In 2026–2027, expect governance wars. Pools will compete not just on rewards, but on values. Decentralization isn’t just a protocol — it’s a choice. And miners will have to choose.

Summary: The Network Got Smarter — But Did We?

Bitcoin’s mining layer has outgrown its grassroots. What used to be a decentralized hustle is now a high-stakes infrastructure race. The difficulty spike in 2025 isn’t just a metric — it’s a message: adapt or fade. The protocol remains open, but the gatekeeping has moved to hardware, energy, and firmware.

What’s Likely in 2026–2027

- Mining becomes energy-native: Farms will be built into power grids, not beside them

- Governance shifts to infrastructure holders: Those who run the rigs will shape consensus

- Tokenized hashpower markets: Hashrate as a tradable asset class may emerge

- Retail miners pivot to staking or L2 roles: Mining as a service, not a solo mission

✅ What Still Makes Sense

- Investing in firmware literacy — knowing your rig’s brain is now essential

- Tracking energy trends — mining ROI is now tied to kilowatts, not just coins

- Joining governance-aware pools — decentralization starts with voting power

❌ What’s Losing Relevance

- Blind hardware upgrades — without energy strategy, it’s sunk cost

- Solo mining dreams — unless you own a dam, it’s nostalgia

- Ignoring policy — ESG and energy audits are coming, whether we like it or not

⚠️ Disclaimer

This article is for educational and informational purposes only. It does not constitute financial, legal, or investment advice. Cryptocurrency mining involves significant risk, including regulatory uncertainty and capital loss. Always consult with a qualified advisor before making decisions.