Polkadot Explained: DOT Token, Architecture & XCM Deep Dive

Polkadot Explained: The Internet of Blockchains

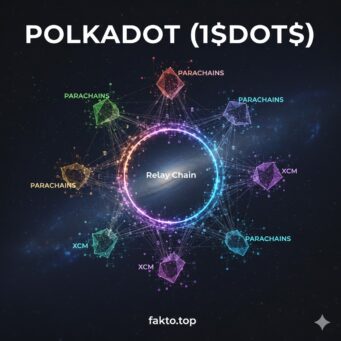

Imagine a world where every blockchain operates in isolation — like apps that can’t talk to each other, locked inside their own silos. This is the core limitation of today’s fragmented crypto landscape. Polkadot was built to solve this problem by becoming the foundational layer — a Layer-0 protocol — that connects and secures specialized blockchains called Parachains. In this guide, we’ll break down Polkadot’s architecture, token utility, and interoperability model to ensure you walk away with zero unanswered questions about the $DOT$ token and its ecosystem.

From Monolithic Chains to Specialized Parachains

Most blockchains today are monolithic — they try to do everything: consensus, smart contracts, governance, and scalability. Polkadot flips this model by introducing modularity. Think of Polkadot as the iPhone operating system, and Parachains as the apps. Each Parachain is a custom-built blockchain optimized for a specific use case — DeFi, identity, gaming, or privacy. This specialization allows for better performance, security, and scalability, while Polkadot handles the heavy lifting of consensus and finality.

Why Specialization Matters

In traditional blockchains, every node must process every transaction, regardless of relevance. This leads to congestion and inefficiency. Polkadot’s architecture allows each Parachain to operate independently while still benefiting from the shared security of the Relay Chain. Developers can build exactly what they need using the Substrate framework, without reinventing the wheel. This modularity is what makes Polkadot scalable and future-proof.

The Blockchain Isolation Problem

Without interoperability, blockchains are like disconnected islands. Assets and data can’t move freely, and innovation is stifled. Polkadot solves this by enabling secure communication between chains — both internal (Parachains) and external (Ethereum, Bitcoin). Its native protocol for internal messaging, XCM, ensures that Parachains can exchange data without relying on risky bridges. This is a game-changer for composability and cross-chain dApps.

Polkadot’s Layer-0 Advantage

Unlike Layer-1 chains like Ethereum or Solana, Polkadot doesn’t host smart contracts directly. Instead, it provides the infrastructure for others to build on top. This makes it more secure and flexible. The Relay Chain focuses solely on consensus and finality, while Parachains handle execution. This separation of concerns is what allows Polkadot to scale horizontally — adding more chains without compromising performance.

What You’ll Learn in This Guide

We’ll dive deep into Polkadot’s architecture, tokenomics, staking model, governance, and interoperability protocols. You’ll understand how Parachain auctions work, what makes Nominated Proof-of-Stake (NPoS) unique, and how Polkadot compares to Cosmos. Each section is packed with practical examples, strategic tables, and analogies to make complex concepts clear. Whether you’re a developer, investor, or crypto enthusiast, this guide is your one-stop resource for mastering Polkadot.

Polkadot Architecture: The Power of the Relay Chain

At the heart of Polkadot lies the Relay Chain — a minimalistic, high-performance blockchain designed to do just three things: provide security, achieve consensus, and finalize transactions. It does not support smart contracts or complex logic by design. This deliberate simplicity allows it to scale and remain secure while serving as the backbone for all connected Parachains. Think of it as the operating system kernel — invisible to most users, but absolutely critical for system integrity.

Shared Security: A Unique Value Proposition

Polkadot’s most powerful innovation is its Shared Security model. Unlike Cosmos, where each chain must secure itself, Polkadot allows all Parachains to inherit the security of the Relay Chain. This means developers don’t need to bootstrap their own validator sets or worry about attack vectors — they get enterprise-grade security out of the box. It’s like plugging into a secure power grid instead of building your own generator.

Why the Relay Chain Doesn’t Host Smart Contracts

By excluding smart contracts, the Relay Chain avoids bloat and complexity. Its sole job is to validate blocks from Parachains, finalize them, and maintain consensus. This separation of execution (Parachains) and validation (Relay Chain) is what enables Polkadot to scale horizontally. Each Parachain can be optimized for its own use case, while the Relay Chain ensures that all chains remain secure and synchronized.

Parachains Explained: Specialized Blockchains

Parachains are independent blockchains that connect to the Relay Chain. Each one is tailored for a specific purpose — whether it’s DeFi, identity, gaming, or privacy. They run their own logic, smart contracts, and governance models, but rely on the Relay Chain for finality and security. To connect, projects must acquire a Parachain slot, which is leased via an auction mechanism.

Parachain Slots and Auctions

Polkadot limits the number of active Parachains to maintain performance. Slots are allocated through Parachain auctions, where projects bond $DOT$ tokens to win a lease. These auctions use a candle-style format — a randomized closing time that prevents last-minute bidding. Users can support projects via Crowdloans, locking their $DOT$ in exchange for project tokens. This creates a powerful incentive alignment between users and builders.

The Guardians: Validators, Collators, and Fishermen

Polkadot’s security model relies on three specialized roles:

- Validators: Secure the Relay Chain by validating blocks and participating in consensus. They are selected via staking and play a critical role in Shared Security.

- Collators: Operate on Parachains, collecting transactions and producing blocks to be validated by the Relay Chain.

- Fishermen: Monitor the network for malicious behavior and report it. They act as decentralized watchdogs, incentivized to keep the system honest.

This triad ensures that Polkadot remains secure, scalable, and resilient — even as new Parachains join the ecosystem.

Substrate: The Framework for Custom Parachains

Substrate is Polkadot’s development toolkit — a modular framework that lets teams build blockchains quickly and efficiently. It’s like Lego for blockchain architecture: developers can choose pre-built modules for consensus, governance, and networking, or write their own. Substrate is tightly integrated with Polkadot, meaning any chain built with it can become a Parachain with minimal friction. This lowers the barrier to entry and accelerates innovation across the ecosystem.

DOT Token Utility: Governance, Staking, and Parachain Auctions

The $DOT$ token is the lifeblood of the Polkadot ecosystem. It serves three core functions: governance, staking, and bonding for Parachain auctions. Unlike many utility tokens that serve a single purpose, $DOT$ is deeply embedded in the protocol’s mechanics, giving holders real influence and economic incentives. Understanding how $DOT$ works is essential for anyone looking to participate in or invest in the Polkadot network.

DOT Staking Explained: The NPoS Model

Polkadot uses a unique staking mechanism called Nominated Proof-of-Stake (NPoS). In this model, token holders nominate validators they trust, rather than running nodes themselves. This creates a more inclusive and secure system, where good behavior is rewarded and malicious actors are slashed. NPoS balances decentralization with performance, allowing thousands of nominators to participate without bloating the network.

Staking rewards vary based on network conditions, validator performance, and the total amount staked. Unbonding periods typically last 28 days, during which staked tokens cannot be moved. Slashing penalties apply if validators act dishonestly or go offline. Choosing reliable validators and diversifying nominations is key to minimizing risk.

| Metric | Current Estimate |

|---|---|

| Annual Percentage Rate (APR) | 14–18% |

| Unbonding Period | 28 days |

| Minimum Stake (approx.) | 120 DOT |

Parachain Slot Auctions: The Engine of Growth

To become a Parachain, projects must win a slot via a Parachain auction. These auctions use a candle-style format, where the closing time is randomized to prevent last-minute bidding. Projects bond $DOT$ to secure a lease, typically lasting 96 weeks. Because most teams don’t have enough $DOT$ on hand, they launch Crowdloans — campaigns where users lock their tokens in support of a project and receive rewards in return.

Crowdloans are non-custodial and reversible: users retain ownership of their $DOT$, which is returned after the lease ends. In exchange, they receive project tokens, often with bonus multipliers. This model creates strong community alignment and bootstraps liquidity for new chains. It also introduces a new layer of investment strategy — choosing which projects to support based on fundamentals, tokenomics, and roadmap.

Polkadot Governance: True Decentralized Voting

Governance in Polkadot is not an afterthought — it’s a core protocol feature. The system is composed of three bodies:

- The Council: Elected representatives who propose referenda and manage treasury spending.

- The Technical Committee: Developers who fast-track emergency upgrades and ensure technical integrity.

- Referenda: Open voting mechanisms where all $DOT$ holders can vote on proposals.

This tri-layered model allows Polkadot to evolve without hard forks. Upgrades are proposed, voted on, and enacted transparently. Governance participation is incentivized, and proposals range from runtime upgrades to treasury grants. The system is flexible, resilient, and truly decentralized.

| DOT Supply Allocation | Approximate Distribution |

|---|---|

| Staking Pool | 55% |

| Foundation & Treasury | 20% |

| Private Sale & Investors | 15% |

| Team & Advisors | 10% |

Cross-Chain Communication (XCM): The Secure Interoperability Standard

Let’s be honest — most blockchains today are like walled gardens. They’re great at doing their own thing, but when it comes to talking to other chains? It’s messy, risky, and often downright impossible. That’s where Polkadot’s XCM protocol comes in. It’s not just another bridge — it’s a native language for secure, seamless communication between Parachains. Built directly into the Relay Chain, XCM lets chains exchange assets, data, and instructions without relying on external validators or vulnerable third-party bridges.

Think of XCM Like Internal Bank Transfers

Imagine sending money between two accounts at the same bank — fast, secure, and no middlemen. That’s XCM. Now compare that to sending money overseas via wire transfer — slow, expensive, and full of risk. That’s how most cross-chain bridges work today. XCM eliminates that friction by keeping everything inside the Polkadot ecosystem, with shared security and native trust baked in.

Polkadot Bridges: Connecting to External Chains

Of course, not everything lives inside Polkadot. That’s why bridges still matter — they connect Polkadot to external networks like Ethereum, Bitcoin, and others. But here’s the key difference: while XCM handles internal communication, Polkadot Bridges are designed for external interoperability. They’re being built with security-first principles, using trusted collators and verification mechanisms to reduce the risks that plague traditional bridges.

Some notable bridge projects include Snowfork (Ethereum), Interlay (Bitcoin), and ChainBridge. These bridges aim to bring liquidity and assets into the Polkadot ecosystem, but they’re optional — not foundational. Polkadot’s real strength lies in its internal composability via XCM.

Polkadot vs Cosmos: Two Approaches to the Multi-Chain World

Now let’s talk philosophy. Both Polkadot and Cosmos want to build a multi-chain future, but they take very different paths to get there. Polkadot believes in Shared Security — one secure base layer (Relay Chain) that protects all connected chains. Cosmos, on the other hand, prioritizes Sovereignty — each chain is fully independent and responsible for its own security.

Neither approach is “better” — they’re just different. Polkadot offers tighter integration and easier interoperability, while Cosmos gives developers more freedom and control. If you’re building a chain that needs deep collaboration with others, Polkadot might be the better fit. If you want full autonomy and don’t mind managing your own validator set, Cosmos could be your playground.

| Feature | Polkadot | Cosmos |

|---|---|---|

| Security Model | Shared via Relay Chain | Independent per chain |

| Interoperability | XCM (native) | IBC (external) |

| Governance | On-chain, unified | Per-chain, sovereign |

| Developer Experience | Substrate framework | Cosmos SDK |

Risks, Rewards, and Investment Advice

Let’s get real — no blockchain is perfect, and Polkadot is no exception. While its architecture is elegant and its vision compelling, there are trade-offs every investor and developer should understand. The good news? Polkadot is transparent about its strengths and weaknesses, and the community is actively working to improve the ecosystem. Whether you’re staking $DOT$, backing a Parachain, or building on Substrate, knowing the landscape helps you make smarter decisions.

Strengths That Set Polkadot Apart

Polkadot’s biggest strength is its Shared Security model. It removes the burden of securing individual chains and allows developers to focus on building. The modularity of Substrate also means faster development cycles and more innovation. Add to that the native interoperability via XCM, and you’ve got a network that’s built for collaboration, not isolation.

Challenges and Weaknesses

But it’s not all smooth sailing. One of the main criticisms is the complexity of Parachain leasing. Projects must win auctions, which can be expensive and time-consuming. This creates a barrier for smaller teams and introduces uncertainty. Additionally, while Polkadot’s governance is flexible, it can be slow-moving — proposals take time to pass, and voter turnout isn’t always high.

Opportunities on the Horizon

Polkadot is still evolving, and that’s a good thing. The adoption of XCM opens doors for truly composable dApps, where assets and logic can flow across chains. As more Parachains go live, we’ll see new use cases emerge — from privacy-preserving tech to decentralized identity. The ecosystem is growing, and early adopters have a chance to shape its direction.

Threats to Watch

Competition is fierce. Ethereum’s Layer-2 solutions are gaining traction, and Cosmos continues to attract developers with its sovereignty-first approach. Polkadot must prove that its model scales and delivers real-world value. Regulatory uncertainty is another wildcard — especially around staking and governance tokens. Staying informed and diversified is key.

| Category | Details |

|---|---|

| Strengths | Shared Security, Substrate modularity, XCM interoperability |

| Weaknesses | Parachain leasing complexity, slow governance cycles |

| Opportunities | Cross-chain dApps, new Parachain use cases, growing developer ecosystem |

| Threats | Ethereum L2 competition, Cosmos adoption, regulatory shifts |

Your Final Questions Answered: The Polkadot FAQ

Still have questions? You’re not alone. Here are some of the most common queries we hear from developers, investors, and crypto-curious readers — answered clearly and concisely.

Is DOT inflationary?

Yes, but it’s controlled. DOT has an inflation rate of around 10% annually, with most new tokens going to stakers. This incentivizes network participation and helps secure the Relay Chain.

What’s the difference between a Parachain and a Parathread?

Parachains are long-term leased slots, while Parathreads are pay-as-you-go. Parathreads allow smaller projects to participate without winning a full auction — perfect for testing or low-volume use cases.

How often do Parachain auctions happen?

Auctions are scheduled in batches, typically every few weeks. Each batch includes multiple slots, and projects compete simultaneously. The exact timing depends on governance decisions and network demand.

Can I unstake DOT anytime?

Not instantly. There’s a 28-day unbonding period after you initiate unstaking. During this time, your tokens are locked and not earning rewards.

What happens if my nominated validator gets slashed?

You may lose a portion of your staked DOT. That’s why it’s crucial to nominate reliable validators with good track records. Diversifying nominations can also reduce risk.

Is Polkadot EVM-compatible?

Not directly. The Relay Chain doesn’t support smart contracts, but some Parachains like Moonbeam offer full EVM compatibility. This allows Ethereum developers to deploy dApps with minimal changes.

How do upgrades happen in Polkadot?

Through on-chain governance. Proposals are submitted, voted on, and enacted without forks. This makes Polkadot highly adaptable and future-proof.

Conclusion: The Long-Term Vision of Layer-0

Polkadot isn’t just another blockchain — it’s a foundational layer for the future of Web3. By solving the blockchain isolation problem, enabling secure interoperability, and offering a modular framework for innovation, it sets the stage for a truly connected, scalable, and secure decentralized internet. Whether you’re building, staking, or exploring, Polkadot invites you to be part of something bigger — a multi-chain world where collaboration beats competition.

As the ecosystem matures, expect more Parachains, better tooling, and deeper integrations. The $DOT$ token will continue to play a central role, not just as a speculative asset, but as a governance and security primitive. If you believe in a future where blockchains work together instead of apart, Polkadot is a bet worth considering.